Comcast 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53 Comcast 2006 Annual Report Notes to Consolidated Financial Statements

Equity Method

Our recorded investments exceed our proportionate interests in

the book value of the investees’ net assets by $984 million and

$1.210 billion as of December 31, 2006 and 2005, respectively

(principally related to our investments in TKCCP (50% interest),

Insight Midwest (50% interest), and MGM (20% interest)). A por-

tion of this basis difference has been attributed to franchise-related

customer relationships of some of the investees. This difference is

amortized to equity in (loss) income of affiliates, net over a period of

four years. The portion of the basis difference attributable to good-

will is tested for impairment annually, or more frequently whenever

events or changes in circumstances indicate that the investment

might be impaired.

SpectrumCo, LLC

SpectrumCo, LLC (“SpectrumCo”), a consortium of investors includ-

ing us, was the successful bidder for 137 wireless spectrum

licenses for approximately $2.4 billion in the Federal Communi-

cations Commission’s advanced wireless spectrum auction that

concluded in September 2006. Our portion of the total cost to

purchase the licenses was approximately $1.3 billion. Based on its

currently planned activities, we have determined that SpectrumCo

is not a VIE. We account for this joint venture as an equity method

investment based on its governance structure, notwithstanding our

majority interest.

Dissolution of TKCCP

In October 2006, we contributed $1.362 billion to TKCCP to refi-

nance the outstanding bank and partnership debt of the Houston

Asset Pool. We have historically accounted for our interest in

TKCCP as an equity method investment. However, effective July 1,

2006 (the beginning of the month when dissolution was initiated),

the economic return to us on our interest in TKCCP tracked the

performance of the Houston Asset Pool, and we were no longer

entitled to any benefits of ownership or responsible for the obliga-

tions of the Kansas City Asset Pool. As a result, we began reporting

our share of the earnings and losses of TKCCP based solely on the

operating results of the Houston Asset Pool. For segment reporting

purposes, we have included the operating results of the Houston

Asset Pool in our Cable segment. However, the operating results of

the Houston Asset Pool are eliminated in our consolidated financial

statements (see Note 14). On January 1, 2007, the distribution of

assets of TKCCP was completed and we received the Houston

Asset Pool (see Note 5).

MGM

In April 2005, we completed a transaction with a group of investors

to acquire Metro-Goldwyn-Mayer Inc. We acquired a 20% eco-

nomic interest for approximately $250 million in cash.

DHC Ventures, LLC

In September 2004, we sold our 20% interest in DHC Ventures,

LLC (“Discovery Health Channel”) to Discovery Communications,

Inc. for approximately $149 million in cash and recognized a gain

on the sale of approximately $94 million to other income.

Cost Method

AirTouch Communications, Inc.

We hold two series of preferred stock of AirTouch Communica-

tions, Inc. (“AirTouch”), a subsidiary of Vodafone, that are recorded

at $1.451 billion and $1.437 billion as of December 31, 2006 and

2005, respectively. The dividend and redemption activity of the

AirTouch preferred stock is tied to the dividend and redemption

payments associated with substantially all of the preferred shares

issued by one of our consolidated subsidiaries, which is a VIE. The

subsidiary has three series of preferred stock outstanding with an

aggregate redemption value of $1.750 billion. Substantially all of

the preferred shares are redeemable in April 2020 at a redemp-

tion value of $1.650 billion, with one of the series bearing a 9.08%

dividend rate. The two redeemable series of subsidiary preferred

shares are recorded at $1.451 billion and $1.437 billion, and such

amounts are included in other noncurrent liabilities as of Decem-

ber 31, 2006 and 2005, respectively. The non-redeemable series

of subsidiary preferred shares is recorded at $100 million as of both

December 31, 2006 and 2005, and such amounts are included in

minority interest.

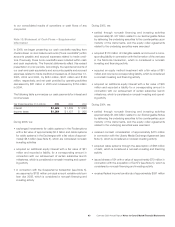

Investment Income (Loss), Net

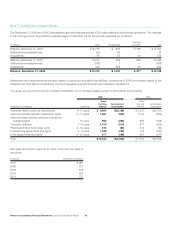

Investment income (loss), net includes the following:

Year Ended December 31 (in millions) 2006 2005 2004

Interest and dividend income $ 178 $ 112 $ 160

Gains on sales and exchanges

of investments, net 733 17 45

Investment impairment losses (4) (3) (16)

Unrealized gains (losses) on

trading securities and

hedged items 339 (259) 378

Mark to market adjustments on

derivatives related to trading

securities and hedged items (238) 206 (120)

Mark to market adjustments on

derivatives (18) 16 25

Investment income (loss), net $ 990 $ 89 $ 472

In connection with the Adelphia and Time Warner transactions, we

recognized gains of approximately $646 million, in the aggregate,

on the Redemptions and the exchange of cable systems held by

Century and Parnassos (see Note 5). These gains are included

within the “Gains on sales and exchanges of investments, net”

caption in the table above.