Comcast 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements Comcast 2006 Annual Report 44

gains or losses resulting from changes in fair value between mea-

surement dates as a component of investment income (loss), net.

We recognize realized gains and losses associated with our fair

value method investments using the specific identification method.

We use the equity method to account for investments in which we

have the ability to exercise significant influence over the investee’s

operating and financial policies. Equity method investments are

recorded at original cost and adjusted to recognize our propor-

tionate share of the investee’s net income or losses after the date

of investment, amortization of basis differences, additional contri-

butions made and dividends received, and impairment charges

resulting from adjustments to fair value. We generally record our

share of the investee’s net income or loss one quarter in arrears

due to the timing of our receipt of such information.

If a consolidated subsidiary or equity method investee issues addi-

tional securities that change our proportionate share of the entity,

we recognize the change as a gain or loss in our consolidated

statement of operations. In cases where gain realization is not

assured, we record the gain to additional capital.

Restricted publicly traded investments and investments in privately

held companies are stated at cost and adjusted for any known

decrease in value (see Note 6).

Property and Equipment

Property and equipment are stated at cost. We capitalize improve-

ments that extend asset lives and expense other repairs and

maintenance charges as incurred. For assets that are sold or retired,

we remove the applicable cost and accumulated depreciation and,

unless the gain or loss on disposition is presented separately, we

recognize it as a component of depreciation expense.

We capitalize the costs associated with the construction of our

cable transmission and distribution facilities and new service instal-

lations. Costs include all direct labor and materials, as well as

various indirect costs.

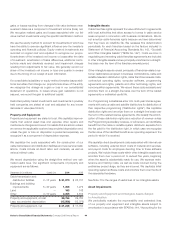

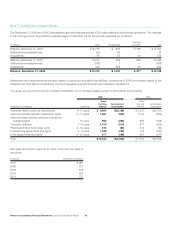

We record depreciation using the straight-line method over esti-

mated useful lives. Our significant components of property and

equipment are as follows:

December 31 (in millions) Useful Life 2006 2005

Cable transmission and

distribution facilities 2 –15 years $ 31,870 $ 25,737

Buildings and building

improvements 5 – 40 years 1,366 1,279

Land — 163 148

Other 3 –10 years 3,355 2,619

Property and equipment, at cost 36,754 29,783

Less: accumulated depreciation (15,506) (12,079)

Property and equipment, net $ 21,248 $ 17,704

Intangible Assets

Cable franchise rights represent the value attributed to agreements

with local authorities that allow access to homes in cable service

areas acquired in connection with business combinations. We do

not amortize cable franchise rights because we have determined

that they have an indefinite life. We reassess this determination

periodically for each franchise based on the factors included in

Statement of Financial Accounting Standards No. 142, “Goodwill

and Other Intangible Assets” (“SFAS No. 142”). Costs we incur in

negotiating and renewing cable franchise agreements are included

in other intangible assets and are principally amortized on a straight-

line basis over the term of the franchise renewal period.

Other intangible assets consist principally of franchise-related cus-

tomer relationships acquired in business combinations, cable and

satellite television distribution rights, cable franchise renewal costs,

contractual operating rights, computer software, programming

agreements and rights, patents and other technology rights, and

noncompetition agreements. We record these costs as assets and

amortize them on a straight-line basis over the term of the related

agreements or estimated useful life.

Our Programming subsidiaries enter into multi-year license agree-

ments with various cable and satellite distributors for distribution of

their respective programming (“distribution rights”). We capitalize

distribution rights and amortize them on a straight-line basis over

the term of the related license agreements. We classify the amorti-

zation of these distribution rights as a reduction of revenue unless

the Programming subsidiary receives, or will receive, an identifiable

benefit from the cable or satellite system distributor separate from

the fee paid for the distribution right, in which case we recognize

the fair value of the identified benefit as an operating expense in the

period in which it is received.

We capitalize direct development costs associated with internal-use

software, including external direct costs of material and services,

and payroll costs for employees devoting time to these software

projects. We include these costs within other intangible assets and

amortize them over a period not to exceed five years, beginning

when the asset is substantially ready for use. We expense main-

tenance and training costs, as well as costs incurred during the

preliminary project stage, as they are incurred. We capitalize initial

operating system software costs and amortize them over the life of

the associated hardware.

See Note 7 for the ranges of useful lives of our intangible assets.

Asset Impairments

Property and Equipment and Intangible Assets Subject

to Amortization

We periodically evaluate the recoverability and estimated lives

of our property and equipment and intangible assets subject to

amortization in accordance with SFAS No. 144, “Accounting for the