Comcast 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59 Comcast 2006 Annual Report Notes to Consolidated Financial Statements

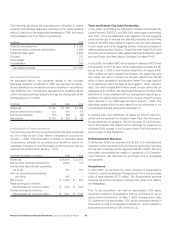

We also maintain a deferred stock option plan for certain employ-

ees and directors that provided the optionees with the opportunity

to defer the receipt of shares of our Class A or Class A Special

common stock that would otherwise be deliverable upon exercise

by the optionees of their stock options. As of December 31, 2006,

approximately 2.0 million shares (adjusted to reflect the Stock Split)

of Class A Special common stock were issuable under exercised

options, the receipt of which was irrevocably deferred by the optio-

nees pursuant to our deferred stock option plan.

Stock Option Liquidity Program

During 2004, we repurchased 16.6 million options (adjusted to

reflect the Stock Split) from various nonemployee holders of stock

options under a stock option liquidity program, targeted primarily

to employees of a previously acquired company. The former option

holders received $37 million for their options under the program.

A financial counterparty we engaged in connection with the stock

option liquidity program funded the cost of the program through the

simultaneous purchase by the counterparty of new stock options

from us that had similar economic terms as the options being pur-

chased by us from the option holders. As of December 31, 2006,

13.9 million options remain outstanding, with a weighted-average

exercise price of $30.89 per share (adjusted to reflect the Stock

Split), and these options will expire over the course of the next

six years.

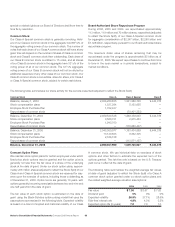

Restricted Stock Plan

We maintain a restricted stock plan under which certain employ-

ees and directors (“Participants”) may be granted restricted share

unit awards in our Class A or Class A Special common stock

(the “Restricted Stock Plan”). Under our Restricted Stock Plan,

approximately 40 million shares (adjusted to reflect the Stock Split)

of our Class A and Class A Special common stock are reserved

for issuance pursuant to awards under the plan, including those

outstanding as of December 31, 2006. Awards of restricted share

units are valued by reference to shares of common stock that enti-

tle Participants to receive, upon the settlement of the unit, one

share of common stock for each unit. The awards vest annually,

generally over a period not to exceed five years from the date of the

award, and do not have voting rights.

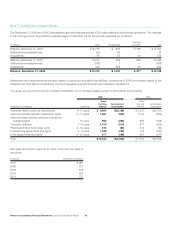

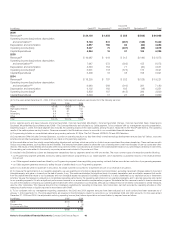

The following table summarizes the weighted-average fair value at

date of grant (adjusted to reflect the Stock Split) and the compen-

sation expense recognized related to restricted share unit awards:

2006 2005 2004

Weighted-average fair value $ 19.98 $ 22.13 $ 20.73

Compensation expense

recognized (in millions) $ 62 $ 57 $ 33

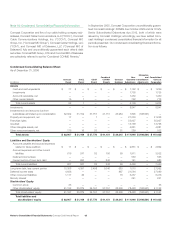

The following table summarizes the activity of our stock option plans for the year ended December 31, 2006 (adjusted to reflect the

Stock Split):

Weighted-Average

Remaining Aggregate

Options Weighted-Average Contractual Term Intrinsic Value

(in thousands) Exercise Price (in years) (in millions)

Class A Common Stock

Outstanding as of January 1, 2006 121,240 $ 24.73

Granted 18,594 $ 18.12

Exercised (12,222) $ 19.18

Forfeited (4,113) $ 19.76

Expired (1,722) $ 26.10

Outstanding as of December 31, 2006 121,777 $ 24.43 5.5 $ 812.3

Exercisable as of December 31, 2006 67,297 $ 28.33 3.6 $ 343.1

Class A Special Common Stock

Outstanding as of January 1, 2006 76,948 $ 20.90

Exercised (10,545) $ 15.31

Forfeited (95) $ 21.75

Expired (1,707) $ 23.96

Outstanding as of December 31, 2006 64,601 $ 21.75 3.5 $ 410.6

Exercisable as of December 31, 2006 57,081 $ 21.95 3.4 $ 353.1