Comcast 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35 Comcast 2006 Annual Report MD&A

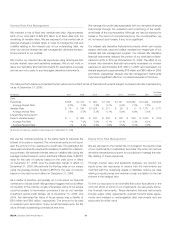

Except as described in “Investment Income (Loss), Net” (see above),

the changes in the fair value of our investments that we accounted

for as trading securities were substantially offset by the changes in

the fair values of the equity derivative financial instruments.

Refer to Note 2 to our consolidated financial statements for a

discussion of our accounting policies for derivative financial instru-

ments and to Note 6 and Note 8 to our consolidated financial

statements for discussions of our derivative financial instruments.

Off-Balance Sheet Arrangements

We do not have any significant off-balance sheet arrangements

that are reasonably likely to have a current or future effect on our

financial condition, results of operations, liquidity, capital expendi-

tures or capital resources.

Critical Accounting Judgments and Estimates

The preparation of our financial statements requires us to make

estimates that affect the reported amounts of assets, liabilities, rev-

enues and expenses, and related disclosure of contingent assets

and contingent liabilities. We base our judgments on historical

experience and on various other assumptions that we believe are

reasonable under the circumstances, the results of which form the

basis for making estimates about the carrying values of assets and

liabilities that are not readily apparent from other sources. Actual

results may differ from these estimates under different assumptions

or conditions.

We believe our judgments and related estimates associated with

the valuation and impairment testing of our cable franchise rights

and the accounting for income taxes and legal contingencies are

critical in the preparation of our financial statements. Management

has discussed the development and selection of these critical

accounting judgments and estimates with the Audit Committee of

our Board of Directors, and the Audit Committee has reviewed our

disclosures relating to them presented below.

Refer to Note 2 to our consolidated financial statements for a

discussion of our accounting policies with respect to these and

other items.

Valuation and Impairment Testing of Cable

Franchise Rights

Our largest asset, our cable franchise rights, results from agree-

ments we have with state and local governments that allow us to

construct and operate a cable business within a specified geo-

graphic area. The value of a franchise is derived from the economic

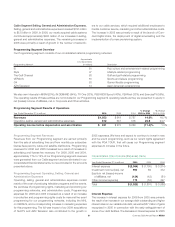

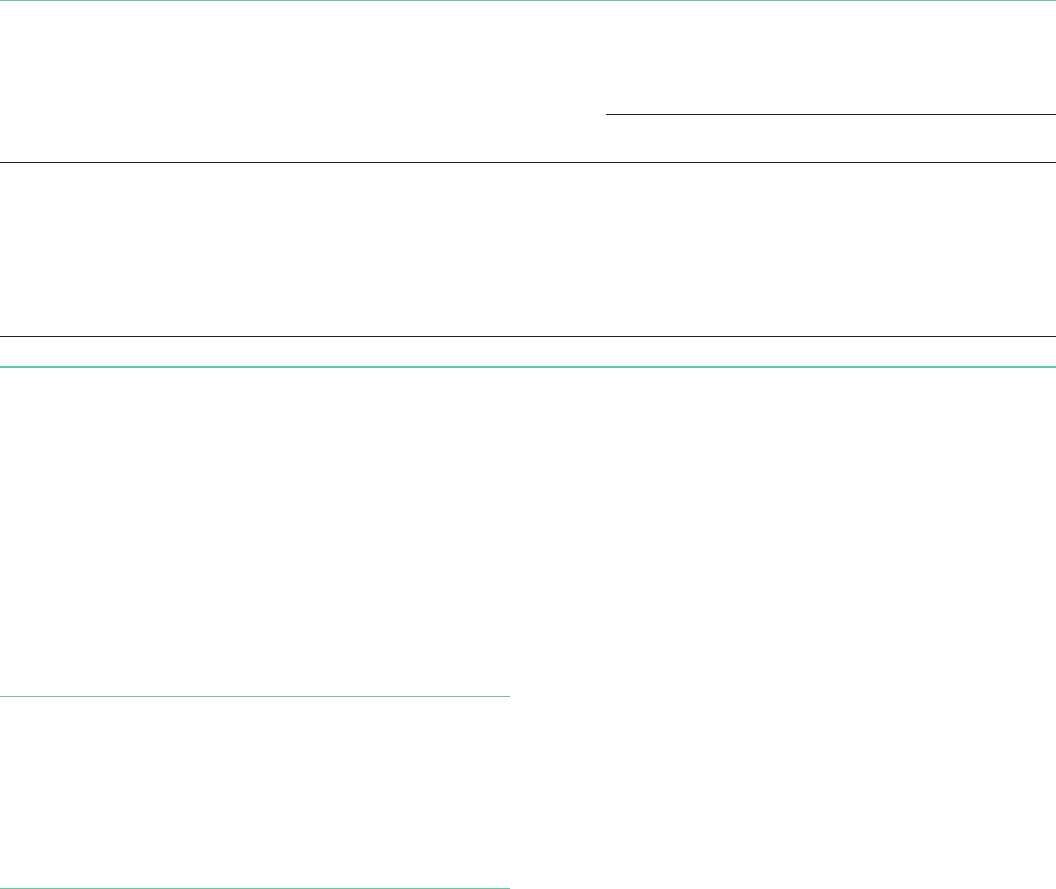

Contractual Obligations

Our unconditional contractual obligations as of December 31, 2006, which consist primarily of our debt obligations and their amounts in

future periods, are summarized in the following table:

Payments Due by Period

Years Years More

(in millions) Total Year 1 2 – 3 4 – 5 than 5

Debt obligations(a) $ 28,909 $ 962 $ 3,900 $ 3,079 $ 20,968

Capital lease obligations 66 21 17 8 20

Operating lease obligations 1,614 292 491 253 578

Purchase obligations(b) 12,068 3,809 3,056 2,150 3,053

Other long-term liabilities reflected on the balance sheet:

Acquisition-related obligations(c) 364 271 75 11 7

Other long-term obligations(d) 4,361 283 449 207 3,422

Total $ 47,382 $ 5,638 $ 7,989 $ 5,707 $ 28,048

Refer to Note 8 (long-term debt) and Note 13 (commitments) to our consolidated financial statements.

(a) Excludes interest payments.

(b) Purchase obligations consist of agreements to purchase goods and services that are legally binding on us and specify all significant terms, including fixed or minimum quantities

to be purchased and price provisions. Our purchase obligations primarily relate to our Cable segment, including contracts with programming networks, customer premise

equipment manufacturers, communication vendors, other cable operators for which we provide advertising sales representation, and other contracts entered into in the normal

course of business. We also have purchase obligations through Comcast Spectacor for the players and coaches of our professional sports teams. We did not include contracts

with immaterial future commitments.

(c) Acquisition-related obligations consist primarily of costs related to terminated employees, costs relating to exiting contractual obligations, and other assumed contractual

obligations of the acquired entity.

(d) Other long-term obligations consist primarily of our prepaid forward sales transactions of equity securities we hold, subsidiary preferred shares, deferred compensation

obligations, pension, postretirement and postemployment benefit obligations, and programming rights payable under license agreements.