Comcast 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements Comcast 2006 Annual Report 60

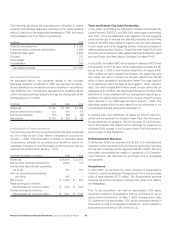

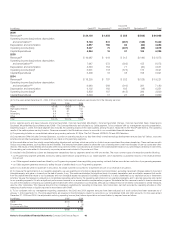

The following table summarizes the activity of the Restricted Stock

Plan for the year ended December 31, 2006 (adjusted to reflect the

Stock Split):

Number of Nonvested Weighted-

Share Unit Awards Average Grant

(in thousands) Date Fair Value

Class A Common Stock

Nonvested awards as of

January 1, 2006 8,474 $ 21.70

Granted 7,539 $ 19.98

Vested (1,635) $ 21.90

Forfeited (894) $ 20.76

Nonvested awards as of

December 31, 2006 13,484 $ 20.78

Class A Special Common Stock

Nonvested awards as of

January 1, 2006 104 $ 24.46

Vested (103) $ 24.75

Nonvested awards as of

December 31, 2006 1 $ 18.31

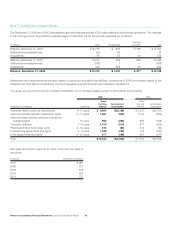

As of December 31, 2006, approximately 605,000 and 145,000

shares (adjusted to reflect the Stock Split) of Class A common

stock and Class A Special common stock, respectively, were issu-

able under vested restricted share unit awards, the receipt of which

was irrevocably deferred by Participants pursuant to the Restricted

Stock Plan.

Share-Based Compensation

Effective January 1, 2006, we adopted SFAS No. 123R using the

Modified Prospective Approach. SFAS No. 123R revises SFAS No.

123 and supersedes APB No. 25. SFAS No. 123R requires the

cost of all share-based payments to employees, including grants

of employee stock options, to be recognized in the financial state-

ments based on their fair values at grant date, or the date of later

modification, over the requisite service period. In addition, SFAS No.

123R requires unrecognized cost (based on the amounts previously

disclosed in our pro forma footnote disclosure) related to options

vesting after the date of initial adoption to be recognized in the

financial statements over the remaining requisite service period.

Under the Modified Prospective Approach, the amount of com-

pensation cost recognized includes: (i) compensation cost for all

share-based payments granted prior to, but not yet vested as of

January 1, 2006, based on the grant date fair value estimated in

accordance with the provisions of SFAS No. 123 and (ii) compen-

sation cost for all share-based payments granted subsequent to

January 1, 2006, based on the grant date fair value estimated in

accordance with the provisions of SFAS No. 123R. Prior to the

adoption of SFAS No. 123R, we recognized the majority of our

share-based compensation costs using the accelerated recognition

method. We recognize the cost of previously granted share-based

awards under the accelerated recognition method and recognize

the cost of new share-based awards on a straight-line basis over

the requisite service period. The incremental pretax share-based

compensation expense recognized due to the adoption of SFAS

No. 123R for the year ended December 31, 2006, was $126 million.

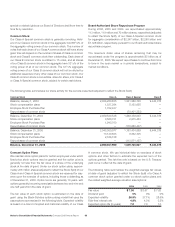

Total share-based compensation expense recognized under SFAS

No. 123R, including the incremental pretax share-based compen-

sation expense, was $190 million, with an associated tax benefit

of $66 million for the year ended December 31, 2006. Prior to the

adoption of SFAS No. 123R, we recognized share-based compen-

sation expense of $67 million and $44 million with associated tax

benefits of $25 million and $16 million for the years ended Decem-

ber 31, 2005 and 2004, respectively. The amount of share-based

compensation capitalized or related to discontinued operations

was not material to our consolidated financial statements.

Cash received from option exercises under all share-based pay-

ment arrangements for the year ended December 31, 2006,

was $372 million. The total intrinsic value (market value on date

of exercise less exercise price) of options exercised for the years

ended December 31, 2006, 2005 and 2004, was $180 million,

$59 million and $88 million, respectively. The tax benefit realized

from stock options exercised for the years ended December 31,

2006, 2005 and 2004, was $62 million, $19 million and $30 million,

respectively.

As of December 31, 2006, there was $207 million of total unrec-

ognized, pretax compensation cost related to nonvested stock

options. This cost is expected to be recognized over a weighted-

average period of approximately two and one half years.

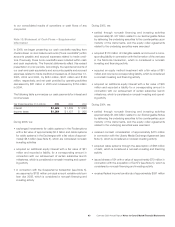

The total fair value of restricted share units vested during the years

ended December 31, 2006, 2005 and 2004, was $32 million, $28

million and $7 million, respectively. As of December 31, 2006,

there was $177 million of total unrecognized pretax compensation

cost related to nonvested restricted share unit awards. This cost

is expected to be recognized over a weighted-average period of

approximately two and one half years.

SFAS No. 123R also required us to change the classification, in our

consolidated statement of cash flows, of any tax benefits realized

upon the exercise of stock options or issuance of restricted share

unit awards in excess of that which is associated with the expense

recognized for financial reporting purposes. These amounts are

presented as a financing cash inflow rather than as a reduction of

income taxes paid in our consolidated statement of cash flows.

The excess cash tax benefit classified as a financing cash inflow for

the year ended December 31, 2006, was $33 million.