Comcast 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comcast 2006 Annual Report 42

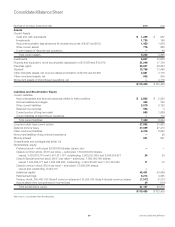

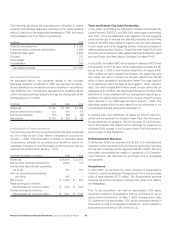

Accumulated Other

Comprehensive Income (Loss)

Treasury Unrealized Cumulative Minimum

Common Stock Class Additional Retained Stock Gains Translation Pension

(in millions) A Special B Capital Earnings At Cost (Losses) Adjustments Liability Total

Balance, January 1, 2004 $ 24 $ 14 $ — $ 44,729 $ 4,552 $ (7,517) $ (112) $ (28) $ — $ 41,662

Comprehensive income:

Net income 970

Reclassification adjustments for

losses included in net income,

net of deferred taxes 1

Cumulative translation adjustments 20

Total comprehensive income 991

Stock compensation plans 130 (73) 57

Repurchase and retirement of

common stock (1) (757) (558) (1,316)

Employee stock purchase plan 28 28

Balance, December 31, 2004 24 13 — 44,130 4,891 (7,517) (111) (8) — 41,422

Comprehensive income:

Net income 928

Unrealized gains on marketable

securities, net of deferred

taxes of $11 20

Reclassification adjustments for

income included in net income,

net of deferred taxes of $2 (4)

Minimum pension liability,

net of deferred taxes of $7 (12)

Cumulative translation adjustments 1

Total comprehensive income 933

Stock compensation plans 120 120

Repurchase and retirement of

common stock (1) (1,294) (994) (2,289)

Employee stock purchase plan 33 33

Balance, December 31, 2005 24 12 — 42,989 4,825 (7,517) (95) (7) (12) 40,219

Comprehensive income:

Net income 2,533

Unrealized gains on marketable

securities, net of deferred

taxes of $69 128

Reclassification adjustments for

income included in net income,

net of deferred taxes of $6 11

Minimum pension liability,

net of deferred taxes of $4 7

Cumulative translation adjustments 2

Total comprehensive income 2,681

Stock compensation plans 604 (33) 571

Repurchase and retirement of

common stock (1) (1,235) (1,111) (2,347)

Employee stock purchase plan 43 43

Balance, December 31, 2006 $ 24 $ 11 $ — $ 42,401 $ 6,214 $ (7,517) $ 44 $ (5) $ (5) $ 41,167

See notes to consolidated financial statements.

Consolidated Statement of Stockholders’ Equity