Comcast 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MD&A Comcast 2006 Annual Report 28

50.8 million RGUs. As a result of continued and growing demand

for our existing and new products and services, including our triple

play offering, as well as other factors discussed below, we have

increased our revenues and operating income before depreciation

and amortization.

REVENUE AND OPERATING INCOME

BEFORE DEPRECIATION AND

AMORTIZATION

(in billions)

$18.2

$20.0

$24.1

$6.9 $7.9

$9.7

200620052004

Revenue

Operating Income Before

Depreciation and Amortization

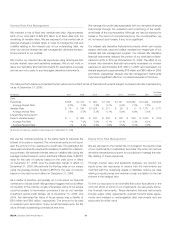

Cable Segment Results of Operations

The comparability of the results of operations and subscriber infor-

mation of our Cable segment are impacted by the Adelphia and

Time Warner transactions (closed July 31, 2006) and the acquisi-

tion of the cable systems of Susquehanna Communications (closed

■

■

April 30, 2006). Further, consistent with our management report-

ing presentation, the operating results and subscriber information

of the cable systems serving Houston, Texas have been included

in the Cable segment beginning August 1, 2006. However, the

operating results of the Houston cable systems are eliminated in

our consolidated financial statements as TKCCP continued to be

accounted for as an equity method investment for external financial

reporting purposes until the Houston cable systems were actually

acquired on January 1, 2007 (see Note 5). We collectively refer

to these cable systems as the “newly acquired cable systems.”

The newly acquired cable systems accounted for $1.7 billion of

increased revenue in 2006.

Cable Segment Revenues

Video. We offer a full range of video services, ranging from a lim-

ited basic service and a digital starter service, to our full digital

cable service, which provides access to over 250 channels, includ-

ing premium and pay-per-view channels; ON DEMAND (which

allows access to a library of movies, sports and news, starting a

selection at any time, and pausing, rewinding and fast-forwarding

selections); music channels; and an interactive, on-screen program

guide (which allows navigating the channel lineup and ON DEMAND

library). Digital cable subscribers may also subscribe to additional

digital cable services, including DVR (which allows digital record-

ing of programs, and pausing and rewinding of live television), and

HDTV (which provides multiple channels in high definition).

As of December 31, 2006, approximately 52% of our video sub-

scribers subscribed to at least one of our digital cable services,

compared to approximately 45% and approximately 39% as of

December 31, 2005 and 2004, respectively.

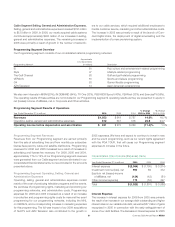

% Change % Change

Year Ended December 31 (in millions) 2006 2005 2004 2005 to 2006 2004 to 2005

Video $ 15,096 $ 12,918 $ 12,211 16.9% 5.8%

High-speed Internet 4,986 3,757 2,938 32.7 27.9

Phone 913 617 620 48.0 (0.5)

Advertising 1,537 1,272 1,206 20.8 5.4

Other 851 789 654 7.8 20.7

Franchise fees 717 634 601 13.1 5.3

Revenues 24,100 19,987 18,230 20.6 9.6

Operating expenses 8,600 7,041 6,656 22.1 5.8

Selling, general and administrative expenses 5,796 4,999 4,634 15.9 7.8

Operating income before depreciation and amortization $ 9,704 $ 7,947 $ 6,940 22.1% 14.5%