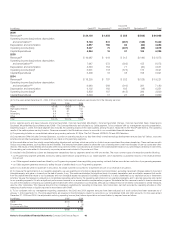

Comcast 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63 Comcast 2006 Annual Report Notes to Consolidated Financial Statements

to our consolidated results of operations or cash flows of any

one period.

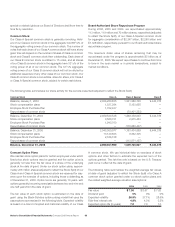

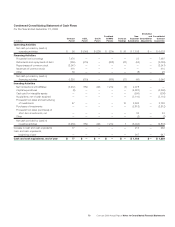

Note 12: Statement of Cash Flows — Supplemental

Information

In 2006, we began presenting our cash overdrafts resulting from

checks drawn on zero balance accounts (“book overdrafts”) within

accounts payable and accrued expenses related to trade credi-

tors. Previously, these book overdrafts were included within cash

and cash equivalents. The financial statements reflect this revised

presentation in prior periods. Accordingly, the reported amounts of

our cash and cash equivalents and accounts payable and accrued

expenses related to trade creditors increased as of December 31,

2005, 2004 and 2003, by $254 million, $341 million and $189

million, respectively, and net cash provided by operating activities

decreased by $87 million in 2005 and increased by $152 million

in 2004.

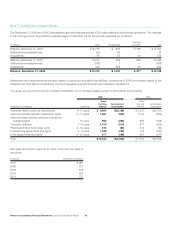

The following table summarizes our cash payments for interest and

income taxes:

Year Ended December 31 (in millions) 2006 2005 2004

Interest $ 1,880 $ 1,809 $ 1,898

Income taxes $ 1,284 $ 1,137 $ 205

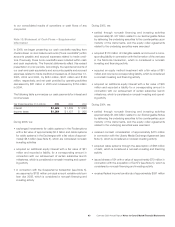

During 2006, we:

• exchanged investments for cable systems in the Redemptions

with a fair value of approximately $3.2 billion and cable systems

for cable systems in the Exchanges with a fair value of approxi-

mately $8.5 billion (see Note 5), which are considered noncash

investing activities

• acquired an additional equity interest with a fair value of $21

million and recorded a liability, for a corresponding amount in

connection with our achievement of certain subscriber launch

milestones, which is considered a noncash investing and operat-

ing activity

• in connection with the Susquehanna transaction (see Note 5),

we assumed a $185 million principal amount variable-rate term

loan due 2008, which is considered a noncash financing and

investing activity

During 2005, we:

• settled through noncash financing and investing activities

approximately $1.347 billion related to our Exchangeable Notes

by delivering the underlying securities to the counterparties upon

maturity of the instruments, and the equity collar agreements

related to the underlying securities were exercised

• acquired $170 million of intangible assets and incurred a corre-

sponding liability in connection with the formation of the ventures

in the Motorola transaction, which is considered a noncash

investing and financing activity

• acquired an equity method investment with a fair value of $91

million and incurred a corresponding liability, which is considered

a noncash investing and financing activity

• acquired an additional equity interest with a fair value of $45

million and recorded a liability for a corresponding amount in

connection with our achievement of certain subscriber launch

milestones, which is considered a noncash investing and operat-

ing activity

During 2004, we:

• settled through noncash financing and investing activities

approximately $1.944 billion related to our Exchangeable Notes

by delivering the underlying securities to the counterparties upon

maturity of the instruments, and the equity collar agreements

related to the underlying securities were exercised

• received noncash consideration of approximately $475 million

in connection with the Liberty Media Exchange Agreement (see

Note 5), which is considered a noncash investing activity

• acquired cable systems through the assumption of $68 million

of debt, which is considered a noncash investing and financing

activity

• issued shares of G4 with a value of approximately $70 million in

connection with the acquisition of TechTV (see Note 5), which is

considered a noncash financing and investing activity

• received federal income tax refunds of approximately $591 million