Comcast 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements Comcast 2006 Annual Report 56

borrowings under the credit facility is LIBOR plus 0.35% based on

our credit ratings.

Lines and Letters of Credit

As of December 31, 2006, we and certain of our subsidiaries had

unused lines of credit totaling $4.464 billion under various credit

facilities and unused irrevocable standby letters of credit totaling

$377 million to cover potential fundings under various agreements.

ZONES

At maturity, holders of our 2.0% Exchangeable Subordinated

Debentures due 2029 (the “ZONES”) are entitled to receive in

cash an amount equal to the higher of the principal amount of

the outstanding ZONES of $1.807 billion or the market value of

24,124,398 shares of Sprint Nextel common stock and 1,205,049

shares of Embarq common stock. Prior to maturity, each ZONES

is exchangeable at the holder’s option for an amount of cash equal

to 95% of the aggregate market value of one share of Sprint Nextel

common stock and 0.05 shares of Embarq common stock.

We separate the accounting for the ZONES into derivative and debt

components. We record the change in the fair value of the deriva-

tive component of the ZONES (see Note 6) and the change in the

carrying value of the debt component of the ZONES as follows:

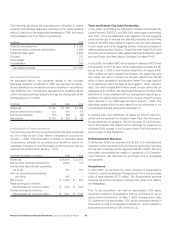

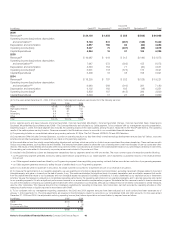

Year Ended December 31, 2006 Debt Derivative

(in millions) Component Component Total

Balance at beginning of year $ 568 $ 184 $ 752

Change in debt component

to interest expense 28 — 28

Change in derivative

component to investment

income (loss), net — (33) (33)

Balance at end of year $ 596 $ 151 $ 747

Interest Rates

Excluding the derivative component of our Exchangeable Notes

due 2007 and the ZONES whose changes in fair value are recorded

to investment income (loss), net, our effective weighted-average

interest rate on our total debt outstanding was 7.07% and 7.32%

as of December 31, 2006 and 2005, respectively. As of Decem-

ber 31, 2006 and 2005, accrued interest was $501 million and

$422 million, respectively.

Interest Rate Risk Management

We are exposed to the market risk of adverse changes in inter-

est rates. To manage the volatility relating to these exposures,

our policy is to maintain a mix of fixed-rate and variable-rate debt

and to enter into various interest rate derivative transactions as

described below.

Using swaps, we agree to exchange, at specified intervals, the

difference between fixed and variable interest amounts calculated

by reference to an agreed-upon notional principal amount. Rate

locks are sometimes used to hedge the risk that the cash flows

related to the interest payments on an anticipated issuance or

assumption of fixed-rate debt may be adversely affected by inter-

est rate fluctuations.

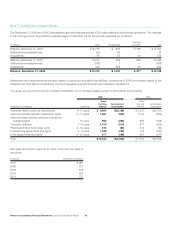

The following table summarizes the terms of our existing swaps:

Notional Average Average Estimated

(in millions) Amount Maturities Pay Rate Receive Rate Fair Value

As of December 31, 2006

Fixed to Variable Swaps $ 3,200 2008 – 2014 7.2% 5.9% $ (103)

As of December 31, 2005

Fixed to Variable Swaps $ 3,600 2006 – 2014 6.5% 6.0% $ (97)

The notional amounts of interest rate instruments, as presented in

the above table, are used to measure interest to be paid or received

and do not represent the amount of exposure to credit loss. The

estimated fair value approximates the proceeds or payments to

settle the outstanding contracts. Swaps and rate locks represent

an integral part of our interest rate risk management program. The

effect of our interest rate derivative financial instruments was to

increase our interest expense by approximately $39 million in 2006,

and to decrease our interest expense by approximately $16 million

and $66 million in 2005 and 2004, respectively.

We have entered into rate locks to hedge the risk that the cash

flows related to the interest payments on an anticipated issuance

or assumption of fixed-rate debt may be adversely affected by

interest-rate fluctuations. Upon the issuance or assumption of

fixed-rate debt, the value of the rate locks is being recognized as

an adjustment to interest expense, similar to a deferred financing

cost, over the same period in which the related interest costs on the

debt are recognized in earnings (approximately 11 years remaining,

unless earlier retired). The unrealized pretax losses on cash flow

hedges as of December 31, 2006 and 2005, of $185 million and