Comcast 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33 Comcast 2006 Annual Report MD&A

$7.497 billion, partially offset by our debt repayments of $2.039 bil-

lion, and our repurchase of approximately 113 million shares of our

Class A Special common stock at a weighted-average share price

of $20.76 for $2.347 billion (recognized on a settlement date or

cash basis and adjusted to reflect the Stock Split). We have made,

and may from time to time in the future make, optional repayments

on our debt obligations, which may include repurchases of our

outstanding public notes and debentures, depending on various

factors, such as market conditions. See Note 8 to our consolidated

financial statements for further discussion of our financing activi-

ties, including details of our debt repayments and borrowings.

Available Borrowings Under Credit Facilities

We traditionally maintain significant availability under lines of credit

and our commercial paper program to meet our short-term liquidity

requirements. As of December 31, 2006, amounts available under

these facilities totaled $4.464 billion.

Debt Covenants

We and our cable subsidiaries that have provided guarantees (see

Note 8) are subject to the covenants and restrictions set forth in the

indentures governing our public debt securities and in the credit

agreement governing our bank credit facilities. We and the guar-

antors are in compliance with the covenants, and we believe that

neither the covenants nor the restrictions in our indentures or loan

documents will limit our ability to operate our business or raise

additional capital. Our covenants are tested on an ongoing basis.

The only financial covenant in our $5.0 billion revolving credit facility

relates to leverage (ratio of debt to operating income before depre-

ciation and amortization), which we met by a significant margin

as of December 31, 2006. Our ability to comply with this financial

covenant in the future does not depend on further debt reduction

or on improved operating results.

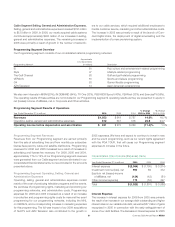

Share Repurchase Program

As of December 31, 2006, the maximum dollar value of shares

remaining that may be repurchased under our Board-authorized

share repurchase program was approximately $3 billion. We expect

such repurchases to continue from time to time in the open market

or in private transactions, subject to market conditions.

SHARE REPURCHASES

(in billions)

$1.4

$2.3 $2.3

200620052004

Investing Activities

Net cash used in investing activities was $9.872 billion for 2006

and consists principally of cash paid for acquisitions of $5.110

billion (primarily related to the Adelphia transaction, Susquehanna

Communications acquisition and the acquisition of our additional

interest in E! Entertainment Television), capital expenditures of

$4.395 billion, and investments of $2.812 billion (primarily related

to our interest in SpectrumCo and the additional funding related

to the dissolution of TKCCP). These cash outflows were partially

offset by proceeds from sales, settlements and restructuring of

investments of $2.720 billion (primarily related to our disposition of

our ownership interest in TWE and TWC).

Refer to Notes 5, 6 and 7 to our consolidated financial statements

for a discussion of our acquisitions and other significant events,

investments, and our intangible assets, respectively.

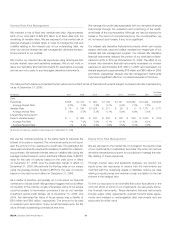

Capital Expenditures

Our most significant recurring investing activity has been capital

expenditures, and we expect that this will continue in the future.

The following chart illustrates the capital expenditures we incurred

in our Cable segment from 2004 through 2006:

CABLE CAPITAL EXPENDITURES

(in billions)

$1.9

$3.4

$2.5

$3.4

$3.2

$4.2

$0.9

$0.3 $0.3

$0.6 $0.6 $0.7

200620052004

New service offerings

Upgrading of cable systems

Recurring capital projects

In 2006, approximately 75% of Cable capital expenditures were

variable and directly associated with continued and growing

demand for our existing and new products and services, which

leads to increases in RGUs. The amounts of capital expenditures

in our Programming segment and our other business activities

have not been significant and have been relatively stable from

2004 through 2006. The amounts of our capital expenditures for

2007 and for subsequent years will depend on numerous factors,

including acquisitions, competition, changes in technology and the

timing and rate of deployment of new services.

■

■

■