Comcast 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

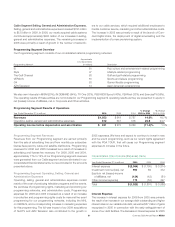

Financial Highlights

(in millions, except number of employees) 2006 2005

Comcast Cable(a)

Revenues $ 26,339 $ 23,556

Operating Cash Flow(b) $ 10,511 $ 9,132

Total Revenue Generating Units(c) 50.8 45.8

Subscribers

Basic Cable 24.2 24.1

Digital Cable 12.7 10.8

High-Speed Internet 11.5 9.6

Phone 2.5 1.3

Consolidated Comcast Corporation

Revenues $ 24,966 $ 21,075

Operating Cash Flow(b) 9,442 8,072

Depreciation and Amortization 4,823 4,551

Operating Income 4,619 3,521

Income from Continuing Operations 2,235 828

Discontinued Operations(e) 298 100

Net Income $ 2,533 $ 928

Shares Outstanding(f) 3,119 3,208

Cash and Short-Term Investments $ 2,974 $ 1,095

Total Assets 110,405 103,400

Total Debt $ 28,975 $ 23,371

Number of Employees 90,000 80,000

Minor differences may exist due to rounding.

Notes and definitions used in the Letter to Shareholders and Financial Highlights:

(a) All Comcast Cable results in the Letter to Shareholders and in these highlights are presented on a pro forma, as adjusted basis. See

reconciliation on page 76.

(b) Operating Cash Flow is defined as operating income before depreciation and amortization, excluding impairment charges related

to fixed and intangible assets and gains or losses on sale of assets, if any. See reconciliation on page 76.

(c) RGUs represent the sum of basic and digital cable, high-speed Internet and phone subscribers, excluding additional outlets.

Subscriptions to DVR and/or HDTV services by existing Comcast Digital Cable customers do not result in additional RGUs.

(d) Free Cash Flow is defined as “Net Cash Provided by Operating Activities From Continuing Operations” (as stated in our Consolidated

Statement of Cash Flows) reduced by capital expenditures and cash paid for intangible assets; and increased by any payments related

to certain non-operating items, net of estimated tax benefits (such as income taxes on investment sales, and non-recurring payments

related to income tax and litigation contingencies of acquired companies). Reconciliation of this item appears on page 76.

(e) In July 2006, in connection with the transactions with Adelphia and Time Warner, we transferred our previously owned cable

systems located in Los Angeles, Cleveland and Dallas to Time Warner Cable. These cable systems are presented as discontinued

operations for the years ended on or before December 31, 2006 (see Note 5 to our consolidated financial statements).

(f) Adjusted to reflect the Stock Split.

Additional information about Comcast is also contained in our Annual Report on Form 10-K and in our Proxy

Statement. We invite you to refer to those documents.

This report may contain forward-looking statements. Readers are cautioned that such forward-looking

statements involve risks and uncertainties that could significantly affect actual results from those expressed in

any such forward-looking statements. Readers are directed to Comcast’s Annual Report on Form 10-K for a

description of such risks and uncertainties.

23

23