Comcast 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49 Comcast 2006 Annual Report Notes to Consolidated Financial Statements

Note 5: Acquisitions and Other Significant Events

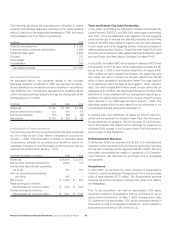

Adelphia and Time Warner Transactions

In April 2005, we entered into an agreement with Adelphia Com-

munications (“Adelphia”) in which we agreed to acquire certain

assets and assume certain liabilities of Adelphia (the “Adelphia

Acquisition”). At the same time, we and Time Warner Cable Inc.

and certain of its affiliates (“TWC”) entered into several agreements

in which we agreed to (i) have our interest in Time Warner Entertain-

ment Company, L.P. (“TWE”) redeemed, (ii) have our interest in TWC

redeemed (together with the TWE redemption, the “Redemptions”),

and (iii) exchange certain cable systems acquired from Adelphia

and certain Comcast cable systems with TWC (the “Exchanges”).

On July 31, 2006, these transactions were completed. We collec-

tively refer to the Adelphia Acquisition, the Redemptions and the

Exchanges as the “Adelphia and Time Warner transactions.” Also

in April 2005, Adelphia and TWC entered into an agreement for the

acquisition of substantially all of the remaining cable system assets

and the assumption of certain of the liabilities of Adelphia.

The Adelphia and Time Warner transactions, which are described

in more detail below, resulted in a net increase of 1.7 million video

subscribers, a net cash payment by us of approximately $1.5 bil-

lion and the disposition of our ownership interests in TWE and

TWC and the assets of two cable system partnerships.

The Adelphia and Time Warner transactions added cable systems

located in 16 states (California, Colorado, Connecticut, Florida,

Georgia, Louisiana, Maryland, Massachusetts, Minnesota, Mis-

sissippi, Oregon, Pennsylvania, Tennessee, Vermont, Virginia and

West Virginia). We expect that the larger systems will result in econ-

omies of scale.

The Adelphia Acquisition

We paid approximately $3.6 billion in cash for the acquisition of

Adelphia’s interest in two cable system partnerships and certain

Adelphia cable systems and to satisfy certain related liabilities.

Approximately $2.3 billion of the amount paid was related to the

acquisition of Adelphia’s interest in Century — TCI California Com-

munications, L.P. (“Century”) and Parnassos Communications, L.P.

(“Parnassos” and together with Century, the “Partnerships”). We

held a 25% interest in Century and a 33.33% interest in Parnas-

sos. Our prior interests in the Partnerships were accounted for as

cost method investments. After acquiring Adelphia’s interests in the

Partnerships, we transferred the cable systems held by the Part-

nerships to TWC in the Exchanges, as discussed further below.

In addition to acquiring Adelphia’s interest in Century and Parnas-

sos, we acquired cable systems from Adelphia for approximately

$600 million in cash that we continue to own and operate.

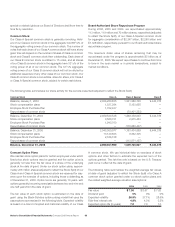

The Redemptions

Our 4.7% interest in TWE was redeemed in exchange for 100% of

the equity interests in a subsidiary of TWE holding cable systems

with a fair value of approximately $600 million and approximately

$147 million in cash. Our 17.9% interest in TWC was redeemed

in exchange for 100% of the capital stock of a subsidiary of TWC

holding cable systems with a fair value of approximately $2.7 billion

and approximately $1.9 billion in cash. Our ownership interests in

TWE and TWC were accounted for as cost method investments.

We recognized a gain of approximately $535 million, in the aggre-

gate, on the Redemptions, which is included in investment income

(loss), net.

The Exchanges

The estimated fair value of the cable systems we transferred to

and received from TWC was approximately $8.6 billion and $8.5

billion, respectively. TWC made net cash payments aggregating

approximately $67 million to us for certain preliminary adjustments

related to the Exchanges.

The cable systems we transferred to TWC included our previously

owned cable systems located in Los Angeles, Cleveland and Dal-

las (“Comcast Exchange Systems”) and the cable systems held

by Century and Parnassos. The operating results of the Comcast

Exchange Systems are reported as discontinued operations for all

periods and are presented in accordance with SFAS No. 144 (see

“Discontinued Operations” below).

As a result of the Exchanges, we recognized a gain on the sale of

discontinued operations of $195 million, net of tax of $541 million

and a gain on the sale of the Century and Parnassos cable systems

of approximately $111 million that is included within investment

income (loss), net.

The cable systems that TWC transferred to us in the Exchanges

included cable systems that TWC acquired from Adelphia in its asset

purchase from Adelphia and TWC’s Philadelphia cable system.

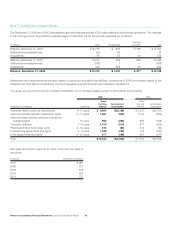

Purchase Price Allocation

The cable systems acquired in the Adelphia and Time Warner

transactions were accounted for in accordance with SFAS No.

141, “Business Combinations” (“SFAS No. 141”). The results of

operations for the acquired cable systems have been included in

our consolidated financial statements since the acquisition date

(July 31, 2006) and are reported in our Cable segment. As a result

of the redemption of our investment in TWC and the exchange of

the cable systems held by Century and Parnassos, we reversed

deferred tax liabilities of approximately $760 million, primarily related

to the excess of tax basis of the assets acquired over the tax basis

of the assets exchanged and reduced the amount of goodwill and

other noncurrent assets that would have otherwise been recorded in

the acquisition. Substantially all of the goodwill recorded is expected

to be amortizable for tax purposes. The purchase price allocation

is preliminary and subject to refinement as valuations are finalized.

The weighted-average amortization period of the franchise-related

customer relationship intangible assets acquired was seven years.