Comcast 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements Comcast 2006 Annual Report 64

Note 13: Commitments and Contingencies

Commitments

Our programming networks have entered into license agreements

for programs and sporting events that are available for telecast.

In addition, we, through Comcast Spectacor, have employment

agreements with both players and coaches of our professional

sports teams. Certain of these employment agreements, which

provide for payments that are guaranteed regardless of employee

injury or termination, are covered by disability insurance if certain

conditions are met.

Certain of our subsidiaries support debt compliance with respect

to obligations of certain cable television partnerships and invest-

ments in which we hold an ownership interest (see Note 6). The

obligations expire between May 2008 and March 2011. Although

there can be no assurance, we believe that we will not be required

to meet our obligations under such commitments. The total notional

amount of our commitments was $965 million as of December 31,

2006, at which time there were no quoted market prices for similar

agreements.

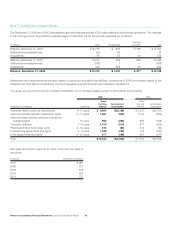

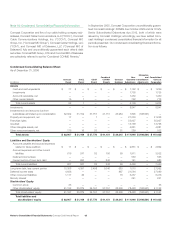

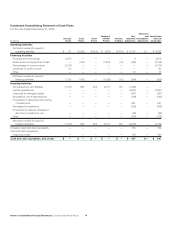

The following table summarizes our minimum annual commitments

under programming license agreements of our programming net-

works and our minimum annual rental commitments for office

space, equipment and transponder service agreements under

noncancelable operating leases:

Program

License Operating

December 31, 2006 (in millions) Agreements Leases

2007 $ 381 $ 292

2008 343 268

2009 273 223

2010 284 147

2011 285 106

Thereafter 2,338 578

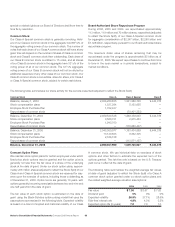

The following table summarizes our rental expense charged to

operations:

Year Ended December 31 (in millions) 2006 2005 2004

Rental expense $ 273 $ 212 $ 184

Contingencies

We and the minority owner group in Comcast Spectacor each

have the right to initiate an exit process under which the fair market

value of Comcast Spectacor would be determined by appraisal.

Following such determination, we would have the option to acquire

the 24.3% interest in Comcast Spectacor owned by the minority

owner group based on the appraised fair market value. In the event

we do not exercise this option, we and the minority owner group

would then be required to use our best efforts to sell Comcast

Spectacor. This exit process includes the minority owner group’s

interest in Comcast SportsNet.

A minority owner of G4 is entitled to trigger an exit process whereby

on May 10, 2009 (the fifth anniversary of the closing date), and on

each successive anniversary of the closing date or the occurrence

of certain other defined events, G4 would be required to purchase

the minority owner’s 15% interest at fair market value (as deter-

mined by an appraisal process). The minority owners in certain of

our technology development ventures also have rights to trigger an

exit process after a certain period of time based on the fair value of

the entities at the time the exit process is triggered.

At Home Cases

Litigation has been filed against us as a result of our alleged con-

duct with respect to our investment in and distribution relationship

with At Home Corporation. At Home was a provider of high-speed

Internet services that filed for bankruptcy protection in Septem-

ber 2001. Filed actions are: (i) class action lawsuits against us,

AT&T (the former controlling shareholder of At Home and also a

former distributor of the At Home service) and others in the United

States District Court for the Southern District of New York, alleging

securities law violations and common law fraud in connection with

disclosures made by At Home in 2001; and (ii) a lawsuit brought

in the United States District Court for the District of Delaware in

the name of At Home by certain At Home bondholders against us,

Brian L. Roberts (our Chairman and Chief Executive Officer and

a director), Cox (Cox is also an investor in At Home and a former

distributor of the At Home service) and others, alleging breaches of

fiduciary duty relating to March 2000 agreements (which, among

other things, revised the distributor relationships), and seeking

recovery of alleged short-swing profits pursuant to Section 16(b)

of the Exchange Act (purported to have arisen in connection with

certain transactions relating to At Home stock effected pursuant to

the March 2000 agreements).

In the Southern District of New York actions (item (i) above), the

court dismissed all claims. The plaintiffs’ appealed this decision,

and the Court of Appeals for the Second Circuit denied the plain-

tiffs’ appeal. The plaintiffs petitioned the Court of Appeals for

rehearing. The Delaware case (item (ii) above) was transferred to

the United States District Court for the Southern District of New

York. The court dismissed the Section 16(b) claims, and the breach

of fiduciary duty claim, for lack of federal jurisdiction. The Court of

Appeals for the Second Circuit denied the plaintiffs’ appeal from

the decision dismissing the Section 16(b) claims, and the U.S.

Supreme Court denied the plaintiffs’ petition for a further appeal.

The plaintiffs recommenced the breach of fiduciary duty claim in

Delaware Chancery Court. The Court has set a trial date in Octo-

ber 2007.