Cigna 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

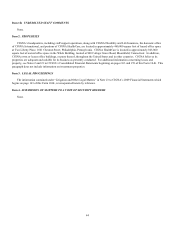

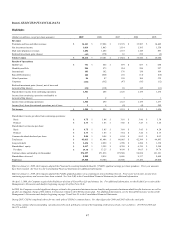

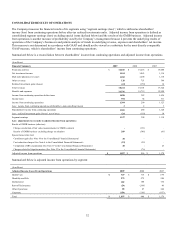

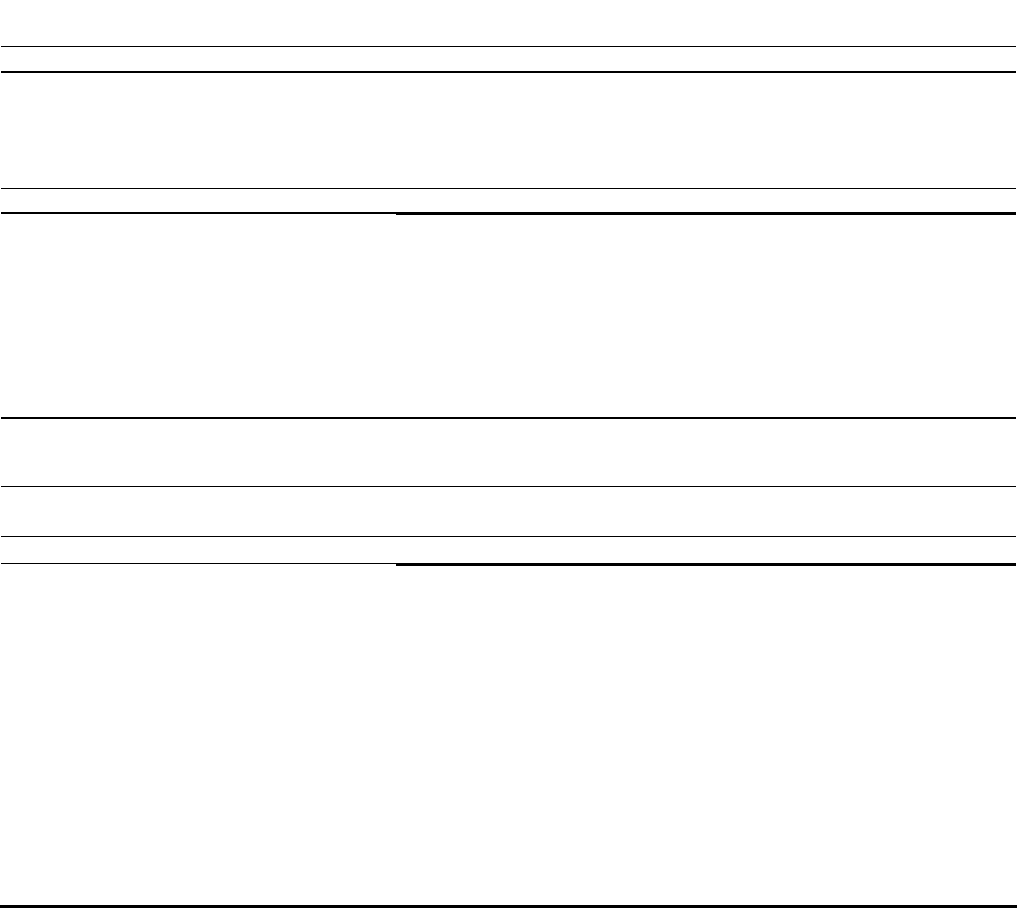

Item 6. SELECTED FINANCIAL DATA

Highlights

(Dollars in millions, except per share amounts) 2009 2008 2007 2006 2005

Revenues

Premiums and fees and other revenues $ 16,161 $ 17,004 $ 15,376 $ 13,987 $ 14,449

Net investment income 1,014 1,063 1,114 1,195 1,358

Mail order pharmacy revenues 1,282 1,204 1,118 1,145 883

Realized investment gains (losses) (43) (170) 16 219 (6)

Total revenues $ 18,414 $ 19,101 $ 17,624 $ 16,546 $ 16,684

Results of Operations:

Health Care $ 731 $ 664 $ 679 $ 653 $ 688

Disability and Life 284 273 254 226 227

International 183 182 176 138 109

Run-off Reinsurance 185 (646) (11) (14) (64)

Other Operations 86 87 109 106 339

Corporate (142) (162) (97) (95) (12)

Realized investment gains (losses), net of taxes and

noncontrolling interest (26) (110) 10 145 (11)

Shareholders' income from continuing operations 1,301 288 1,120 1,159 1,276

Income from continuing operations attributable to

noncontrolling interest 3 2 3 - 1

Income from continuing operations 1,304 290 1,123 1,159 1,277

Income (loss) from discontinued operations, net of taxes 1 4 (5) (4) 349

Net income $ 1,305 $ 294 $ 1,118 $ 1,155 $ 1,626

Shareholders' income per share from continuing operations:

Basic $ 4.75 $ 1.04 $ 3.91 $ 3.46 $ 3.30

Diluted $ 4.73 $ 1.03 $ 3.86 $ 3.43 $ 3.26

Shareholders' net income per share:

Basic $ 4.75 $ 1.05 $ 3.89 $ 3.45 $ 4.20

Diluted $ 4.73 $ 1.05 $ 3.84 $ 3.42 $ 4.15

Common dividends declared per share $ 0.04 $ 0.04 $ 0.04 $ 0.03 $ 0.03

Total assets $ 43,013 $ 41,406 $ 40,065 $ 42,399 $ 44,893

Long-term debt $ 2,436 $ 2,090 $ 1,790 $ 1,294 $ 1,338

Shareholders’ equity $ 5,417 $ 3,592 $ 4,748 $ 4,330 $ 5,360

Per share $ 19.75 $ 13.25 $ 16.98 $ 14.63 $ 14.74

Common shares outstanding (in thousands) 274,257 271,036 279,588 98,654 121,191

Shareholders of record 8,888 9,014 8,696 9,117 9,440

Employees 29,300 30,300 26,600 27,100 28,000

Effective January 1, 2009, the Company adopted the Financial Accounting Standards Board's ("FASB") updated earnings per share guidance. Prior year amounts

have been restated. See Note 4 to the Consolidated Financial Statements for additional information.

Effective January 1, 2009, the Company adopted the FASB's updated guidance on accounting for noncontrolling interests. Prior years' net income, income from

continuing operations, and revenues have been restated. See Note 2(B) to the Consolidated Financial Statements for additional information.

On April 1, 2008, the Company acquired the Healthcare division of Great-West Life and Annuity, Inc. For additional information, see the Health Care section of the

Management’s Discussion and Analysis beginning on page 62 of this Form 10-K.

In 2008, the Company recorded significant charges related to the guaranteed minimum income benefits and guaranteed minimum death benefits businesses as well as

an after-tax litigation charge of $52 million in Corporate related to the CIGNA pension plan. For additional information, see the Run-off Reinsurance section of the

Management’s Discussion and Analysis beginning on page 73 and Note 23 to the Consolidated Financial Statements.

During 2007, CIGNA completed a three-for-one stock split of CIGNA's common shares. Per share figures for 2006 and 2005 reflect the stock split.

Pro forma common shares outstanding, calculated as if the stock split had occurred at the beginning of the prior periods, were as follows: 295,963 in 2006 and

363,573 in 2005.