Cigna 2009 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

Retirement benefits business. The Company had a reinsurance recoverable of $1.7 billion as of December 31, 2009, and $1.9 billion

as of December 31, 2008 from Prudential Retirement Insurance and Annuity Company resulting from the sale of the retirement

benefits business, which was primarily in the form of a reinsurance arrangement. The reinsurance recoverable, which is reduced as

the Company’s reinsured liabilities are paid or directly assumed by the reinsurer, is secured primarily by fixed maturities and

mortgage loans equal to or greater than 100% of the reinsured liabilities held in a trust established for the benefit of the Company. As

of December 31, 2009, the fair value of trust assets exceeded the reinsurance recoverable and S&P had assigned this reinsurer a rating

of AA-.

Individual life and annuity reinsurance. The Company had reinsurance recoverables totaling $4.4 billion as of December 31, 2009

and $4.6 billion as of December 31, 2008 from The Lincoln National Life Insurance Company and Lincoln Life & Annuity of New

York resulting from the 1998 sale of the Company’s individual life insurance and annuity business through indemnity reinsurance

arrangements. A substantial portion of the reinsurance recoverables are secured by investments held in a trust established for the

benefit of the Company. At December 31, 2009, the trust assets secured approximately 90% of the reinsurance recoverables. The

remaining balance is currently unsecured. If Lincoln National Life Insurance Company and Lincoln Life & Annuity of New York do

not maintain a specified minimum credit or claims paying rating, these reinsurers are required to fully secure the outstanding balance.

S&P has assigned each of these companies a rating of AA-.

Other Ceded and Assumed Reinsurance

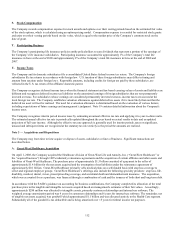

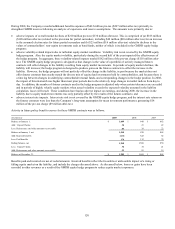

Ceded Reinsurance: Ongoing operations. The Company’s insurance subsidiaries have reinsurance recoverables from various

reinsurance arrangements in the ordinary course of business for its Health Care, Disability and Life, and International segments as

well as the non-leveraged and leveraged corporate-owned life insurance business. Reinsurance recoverables of $294 million as of

December 31, 2009 are expected to be collected from more than 90 reinsurers which have been assigned the following financial

strength ratings by S&P:

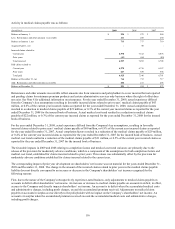

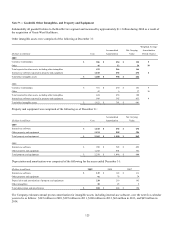

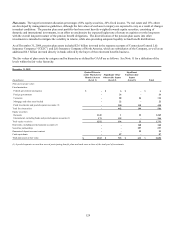

Percent of Reinsurance

Reinsurance Percent Recoverable Protected

Ongoing operations (In millions) Recoverable of Total by Collateral

AA- (Single reinsurer) $ 47 16% 0%

AA- or higher (Other reinsurers) 33 11% 0%

A (Single reinsurer) 29 10% 0%

A+ to A- (Other reinsurers) 111 38% 4%

Unrated (Single reinsurer) 35 12% 99%

Below A- or unrated (Other reinsurers) 39 13% 37%

Total $ 294 100% 18%

The collateral protecting the recoverables includes assets held in trust and letters of credit. The Company reviews its reinsurance

arrangements and establishes reserves against the recoverables in the event that recovery is not considered probable. As of December

31, 2009, the Company’s recoverables related to these segments were net of a reserve of $9 million.

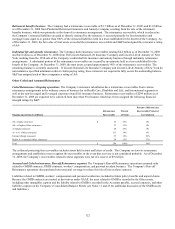

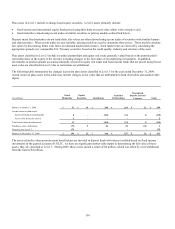

Assumed and Ceded reinsurance: Run-off Reinsurance segment. The Company's Run-off Reinsurance operations assumed risks

related to GMDB contracts, GMIB contracts, workers’ compensation, and personal accident business. The Company’s Run-off

Reinsurance operations also purchased retrocessional coverage to reduce the risk of loss on these contracts.

Liabilities related to GMDB, workers’ compensation and personal accident are included in future policy benefits and unpaid claims.

Because the GMIB contracts are treated as derivatives under GAAP, the asset related to GMIB is recorded in the Other assets,

including other intangibles caption and the liability related to GMIB is recorded in the Accounts payable, accrued expenses, and other

liabilities caption on the Company’s Consolidated Balance Sheets (see Notes 11 and 23 for additional discussion of the GMIB assets

and liabilities).