Cigna 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

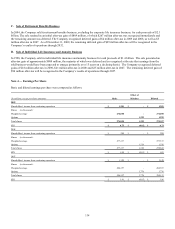

S. Stock Compensation

The Company records compensation expense for stock awards and options over their vesting periods based on the estimated fair value

of the stock options, which is calculated using an option-pricing model. Compensation expense is recorded for restricted stock grants

and units over their vesting periods based on fair value, which is equal to the market price of the Company’s common stock on the

date of grant.

T. Participating Business

The Company’s participating life insurance policies entitle policyholders to earn dividends that represent a portion of the earnings of

the Company’s life insurance subsidiaries. Participating insurance accounted for approximately 1% of the Company’s total life

insurance in force at the end of 2009 and approximately 2% of the Company’s total life insurance in force at the end of 2008 and

2007.

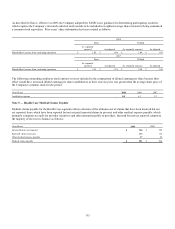

U. Income Taxes

The Company and its domestic subsidiaries file a consolidated United States federal income tax return. The Company's foreign

subsidiaries file tax returns in accordance with foreign law. U.S. taxation of these foreign subsidiaries may differ in timing and

amount from taxation under foreign laws. Reportable amounts, including credits for foreign tax paid by these subsidiaries, are

reflected in the U.S. tax return of the affiliates' domestic parent.

The Company recognizes deferred income taxes when the financial statement and tax-based carrying values of assets and liabilities are

different and recognizes deferred income tax liabilities on the unremitted earnings of foreign subsidiaries that are not permanently

invested overseas. For subsidiaries whose earnings are considered permanently invested overseas, income taxes are accrued at the

local foreign tax rate. The Company establishes valuation allowances against deferred tax assets if it is more likely than not that the

deferred tax asset will not be realized. The need for a valuation allowance is determined based on the evaluation of various factors,

including expectations of future earnings and management’s judgment. Note 19 contains detailed information about the Company's

income taxes.

The Company recognizes interim period income taxes by estimating an annual effective tax rate and applying it to year-to-date results.

The estimated annual effective tax rate is periodically updated throughout the year based on actual results to date and an updated

projection of full year income. Although the effective tax rate approach is generally used for interim periods, taxes on significant,

unusual and infrequent items are recognized at the statutory tax rate entirely in the period the amounts are realized.

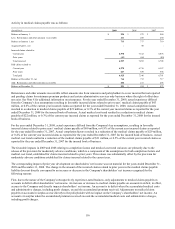

Note 3 — Acquisitions and Dispositions

The Company may from time to time acquire or dispose of assets, subsidiaries or lines of business. Significant transactions are

described below.

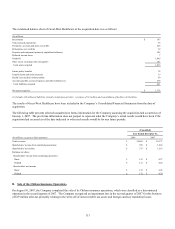

A. Great-West Healthcare Acquisition

On April 1, 2008, the Company acquired the Healthcare division of Great-West Life and Annuity, Inc. (“Great-West Healthcare” or

the “acquired business”) through 100% indemnity reinsurance agreements and the acquisition of certain affiliates and other assets and

liabilities of Great-West Healthcare. The purchase price of approximately $1.5 billion consisted of a payment to the seller of

approximately $1.4 billion for the net assets acquired and the assumption of net liabilities under the reinsurance agreement of

approximately $0.1 billion. Great-West Healthcare primarily sells medical plans on a self-funded basis with stop loss coverage to

select and regional employer groups. Great-West Healthcare’s offerings also include the following specialty products: stop loss, life,

disability, medical, dental, vision, prescription drug coverage, and accidental death and dismemberment insurance. The acquisition,

which was accounted for as a purchase, was financed through a combination of cash and the issuance of both short and long-term debt.

In accordance with the FASB’s guidance on accounting for business combinations, the Company completed its allocation of the total

purchase price to the tangible and intangible net assets acquired based on management's estimates of their fair values. Accordingly,

approximately $290 million was allocated to intangible assets, primarily customer relationships and internal-use software. The

weighted average amortization period was 9 years for customer relationships and 6 years for internal-use software. The remainder, net

of tangible net assets acquired, was goodwill which approximated $1.1 billion and was allocated entirely to the Health Care segment.

Substantially all of the goodwill is tax deductible and is being amortized over 15 years for federal income tax purposes.