Cigna 2009 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.136

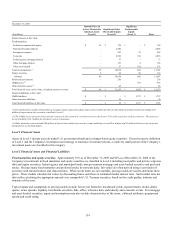

These GMIB assets and liabilities are estimated with a complex internal model using many scenarios to determine the present value of

net amounts expected to be paid, less the present value of net future premiums expected to be received adjusted for risk and profit

charges that the Company estimates a hypothetical market participant would require to assume this business. Net amounts expected to

be paid include the excess of the expected value of the income benefits over the values of the annuitants’ accounts at the time of

annuitization. Generally, market return, interest rate and volatility assumptions are based on market observable

information. Assumptions related to annuitant behavior reflect the Company’s belief that a hypothetical market participant would

consider the actual and expected experience of the Company as well as other relevant and available industry resources in setting

policyholder behavior assumptions. The Company is also required to adjust for nonperformance risk to reflect the market’s perception

of the risk that either the Company will not fulfill its GMIB liability (own credit) or the Company will not collect on its GMIB

retrocessional coverage (reinsurer credit risk). The significant assumptions used to value the GMIB assets and liabilities as of

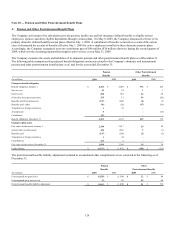

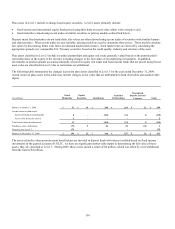

December 31, 2009 were as follows:

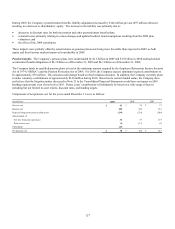

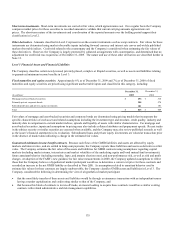

x The market return and discount rate assumptions are based on the market-observable LIBOR swap curve.

x The projected interest rate used to calculate the reinsured income benefits is indexed to the 7-year Treasury Rate at the time of

annuitization (claim interest rate) based on contractual terms. That rate was 3.39% at December 31, 2009 and must be projected

for future time periods. These projected rates vary by economic scenario and are determined by an interest rate model using

current interest rate curves and the prices of instruments available in the market including various interest rate caps and zero-

coupon bonds. For a subset of the business, there is a contractually guaranteed floor of 3% for the claim interest rate.

x The market volatility assumptions for annuitants’ underlying mutual fund investments that are modeled based on the S&P 500,

Russell 2000 and NASDAQ Composite are based on the market-implied volatility for these indices for three to seven years

grading to historical volatility levels thereafter. For the remaining 56% of underlying mutual fund investments modeled based on

other indices (with insufficient market-observable data), volatility is based on the average historical level for each index over the

past 10 years. Using this approach, volatility ranges from 17% to 33% for equity funds, 4% to 12% for bond funds and 1% to 2%

for money market funds.

x The mortality assumption is 70% of the 1994 Group Annuity Mortality table, with 1% annual improvement beginning January 1,

2000.

x The annual lapse rate assumption reflects experience that differs by the company issuing the underlying variable annuity

contracts, ranges from 2% to 17% and depends on the time since contract issue and the relative value of the guarantee.

x The annual annuity election rate assumption reflects experience that differs by the company issuing the underlying variable

annuity contracts and depends on the annuitant’s age, the relative value of the guarantee and whether a contractholder has had a

previous opportunity to elect the benefit. Immediately after the expiration of the waiting period, the assumed probability that an

individual will annuitize their variable annuity contract is up to 80%. For the second and subsequent annual opportunities to elect

the benefit, the assumed probability of election is up to 30%. Actual data is still emerging for the Company as well as the

industry and the estimates are based on this limited data.

x The nonperformance risk adjustment is incorporated by adding an additional spread to the discount rate in the calculation of both

(1) the GMIB liability to reflect a hypothetical market participant’s view of the risk of the Company not fulfilling its GMIB

obligations, and (2) the GMIB asset to reflect a hypothetical market participant’s view of the reinsurers’ credit risk, after

considering collateral. The estimated market-implied spread is company-specific for each party involved to the extent that

company-specific market data is available and based on industry averages for similarly rated companies when company-specific

data is not available. The spread is impacted by the credit default swap (“CDS”) spreads of the specific parent companies,

adjusted to reflect subsidiaries’ credit ratings relative to their parent company. The additional spread over LIBOR incorporated

into the discount rate was 10 to 110 basis points for the GMIB liability and 0 to 140 basis points for the GMIB reinsurance asset

for that portion of the interest rate curve most relevant to these policies.

x The risk and profit charge assumption is based on the Company’s estimate of the capital and return on capital that would be

required by a hypothetical market participant.

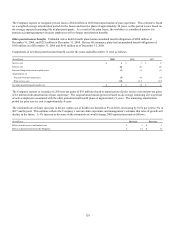

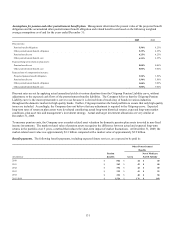

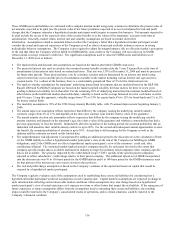

The Company regularly evaluates each of the assumptions used in establishing these assets and liabilities by considering how a

hypothetical market participant would set assumptions at each valuation date. Capital markets assumptions are expected to change at

each valuation date reflecting current observable market conditions. Other assumptions may also change based on a hypothetical

market participant’s view of actual experience as it emerges over time or other factors that impact the net liability. If the emergence of

future experience or future assumptions differs from the assumptions used in estimating these assets and liabilities, the resulting

impact could be material to the Company’s consolidated results of operations, and in certain situations, could be material to the

Company’s financial condition.