Cigna 2009 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

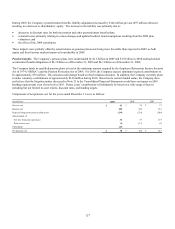

Second, the Company consistently recognizes the actuarial best estimate of the ultimate liability within a level of confidence, as

required by actuarial standards of practice, which require that the liabilities be adequate under moderately adverse conditions. As the

Company establishes the liability for each incurral year, the Company ensures that its assumptions appropriately consider moderately

adverse conditions. When a portion of the development related to the prior year incurred claims is offset by an increase determined

appropriate to address moderately adverse conditions for the current year incurred claims, the Company does not consider that offset

amount as having any impact on shareholders’ net income.

Note 6 — Initiatives to Lower Operating Expenses

As part of its strategy, the Company has undertaken several initiatives to realign its organization and consolidate support functions in

an effort to increase efficiency and responsiveness to customers and to reduce costs.

During 2008 and 2009, the Company conducted a comprehensive review to reduce the operating expenses of its ongoing businesses

(“cost reduction program”). As a result, the Company recognized severance-related and real estate charges in other operating

expenses.

Severance charges in 2008 and 2009 resulted from reductions of approximately 2,350 positions in the Company’s workforce.

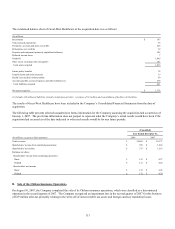

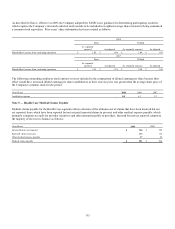

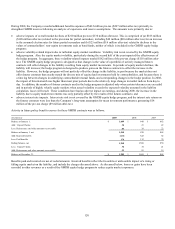

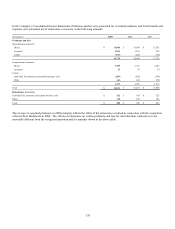

Cost reduction activity for 2008 and 2009 was as follows:

Pre-tax (In millions) Severance Real Estate Total

Fourth Quarter 2008 charge (balance carried to January 1, 2009) $ 44 $ 11 $ 55

Second Quarter 14 - 14

Third Quarter 10 - 10

Fourth Quarter 20 - 20

Subtotal - 2009 charges 44 - 44

Less: Payments 55 3 58

Balance, December 31, 2009 $ 33 $ 8 $ 41

The Health Care segment recorded $37 million pre-tax ($24 million after-tax) of the 2009 charges and $44 million pre-tax ($27

million after-tax) of the 2008 charge. The remainder of the 2009 and 2008 charges were reported as follows: Disability and Life: $5

million pre-tax ($4 million after-tax) in 2009 and $3 million pre-tax ($2 million after-tax) in 2008; and International: $2 million pre-

tax ($1 million after-tax) in 2009 and $8 million pre-tax ($6 million after-tax) in 2008. Substantially all severance is expected to be

paid by the end of 2010.

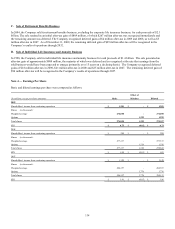

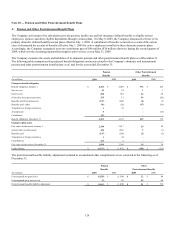

Note 7 Guaranteed Minimum Death Benefit Contracts

The Company’s reinsurance operations, which were discontinued in 2000 and are now an inactive business in run-off mode, reinsured

a guaranteed minimum death benefit (“GMDB”), also known as variable annuity death benefits (“VADBe”), under certain variable

annuities issued by other insurance companies. These variable annuities are essentially investments in mutual funds combined with a

death benefit. The Company has equity and other market exposures as a result of this product. In periods of declining equity markets

and in periods of flat equity markets following a decline, the Company’s liabilities for these guaranteed minimum death benefits

increase. Conversely, in periods of rising equity markets, the Company’s liabilities for these guaranteed minimum death benefits

decrease.