Cigna 2009 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FS-8

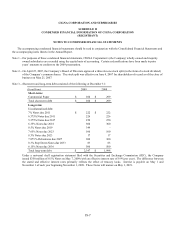

On March 4, 2008, the Company issued $300 million of 6.35% Notes (with an effective interest rate of 6.68% per year). The

difference between the stated and effective interest rates primarily reflects the effect of treasury locks. Interest is payable on

March 15 and September 15 of each year beginning September 15, 2008. These Notes will mature on March 15, 2018.

The Company may redeem these Notes, at any time, in whole or in part, at a redemption price equal to the greater of:

x 100% of the principal amount of the Notes to be redeemed; or

x the present value of the remaining principal and interest payments on the Notes being redeemed discounted at the

applicable Treasury Rate plus 50 basis points.

On March 14, 2008, the Company entered into a new commercial paper program (“the Program”). Under the Program, the

Company is authorized to sell from time to time short-term unsecured commercial paper notes up to a maximum of $500

million. The proceeds are used for general corporate purposes, including working capital, capital expenditures, acquisitions

and share repurchases. The Company uses the credit facility entered into in June 2007, as back-up liquidity to support the

outstanding commercial paper. If at any time funds are not available on favorable terms under the Program, the Company

may use its credit agreement for funding. In October 2008, the Company added an additional dealer to its Program. As of

December 31, 2009, the Company had $100 million in commercial paper outstanding, at a weighted average interest rate of

0.35%, used for general corporate purposes.

In June 2007, the Company amended and restated its five year revolving credit and letter of credit agreement for $1.75

billion, which permits up to $1.25 billion to be used for letters of credit. The credit agreement includes options, which are

subject to consent by the administrative agent and the committing bank, to increase the commitment amount up to $2.0

billion and to extend the term of the agreement. The Company entered into the agreement for general corporate purposes,

including support for the issuance of commercial paper and to obtain statutory reserve credit for certain reinsurance

arrangements. There was a $27 million of letter of credit issued as of December 31, 2009.

Maturities of long-term debt are as follows (in millions): none in 2010, $448 in 2011, none in 2012 and 2013 and the

remainder in years after 2013.

Interest paid on short- and long-term debt amounted to $153 million, $135 million and $116 million for 2009, 2008 and 2007,

respectively.

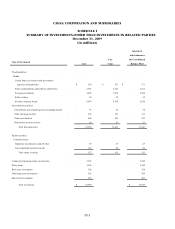

Note 4—Intercompany liabilities consist primarily of loans payable to CIGNA Holdings, Inc. of $4.6 billion as of December 31, 2009

and $5.1 billion as of December 31, 2008. Interest was accrued at an average monthly rate of 1.56% and 4.23% for 2009 and

2008, respectively.