Cigna 2009 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

156

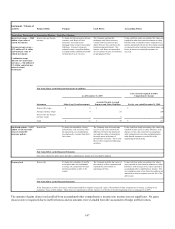

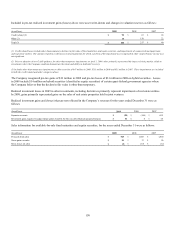

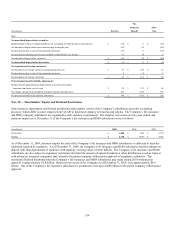

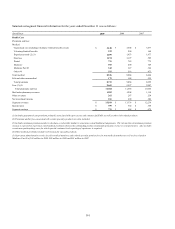

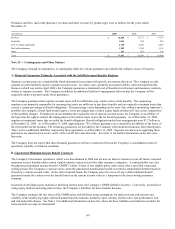

B. Deferred Income Taxes

Deferred income tax assets and liabilities as of December 31 are shown below.

(In millions) 2009 2008

Deferred tax assets

Employee and retiree benefit plans $ 774 $ 921

Investments, net 111 130

Other insurance and contractholder liabilities 430 454

Deferred gain on sale of business 67 78

Policy acquisition expenses 144 147

Loss carryforwards 104 111

Other accrued liabilities 111 110

Bad debt expense 16 22

Other 34 39

Deferred tax assets before valuation allowance 1,791 2,012

Valuation allowance for deferred tax assets (116) (126)

Deferred tax assets, net of valuation allowance 1,675 1,886

Deferred tax liabilities

Depreciation and amortization 291 238

Unrepatriated foreign income, net 151 135

Unrealized appreciation (depreciation) on investments and foreign currency translation 204 (104)

Total deferred tax liabilities 646 269

Net deferred income tax assets $ 1,029 $ 1,617

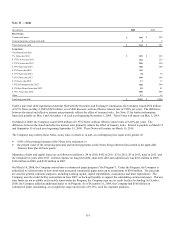

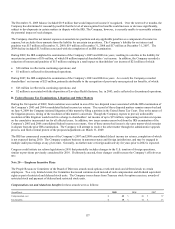

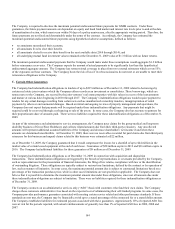

Management believes consolidated taxable income to be generated in the future will be sufficient in amount and character to support

realization of the Company’s net deferred tax assets of $1.0 billion as of December 31, 2009 and $1.6 billion as of December 31,

2008. This determination is based upon the Company’s consistent overall earnings history and future earnings expectations. Other

than deferred tax benefits attributable to operating loss and foreign tax credit carryforwards, there are no constraints on the period of

time within which the Company’s deferred tax assets must be realized. Federal operating loss carryforwards of $283 million were

available to offset future taxable income of the generating companies, and begin to expire in 2022. Foreign tax credit carryforwards of

$11 million were generated in 2009 and may be carried forward 10 years.

The Company’s deferred tax asset is net of a federal and state valuation allowance (see table above). The valuation allowance reflects

management’s assessment that certain deferred tax assets may not be realizable. As was the case at December 31, 2008, the valuation

allowance at December 31, 2009 relates primarily to operating losses, and other deferred tax benefits, of the run-off reinsurance

operations. It is reasonably possible there could be a significant decline in the level of valuation allowance recorded against deferred

tax benefits of the reinsurance operations within the next 12 months.

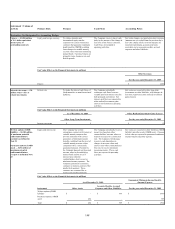

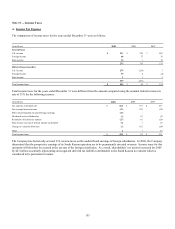

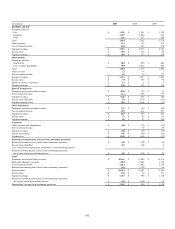

C. Uncertain Tax Positions

A reconciliation of unrecognized tax benefits for the years ended December 31 is as follows:

(In millions) 2009 2008 2007

Balance at January 1, $ 164 $ 260 $ 245

Increase (decrease) due to prior year positions 5 (119) (31)

Increase due to current year positions 76 34 51

Reduction related to settlements with taxing authorities (28) (5) -

Reduction related to lapse of applicable statute

of limitations (3) (6) (5)

Balance at December 31, $ 214 $ 164 $ 260