Cigna 2009 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.146

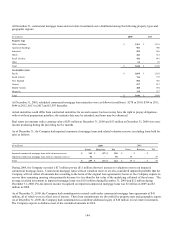

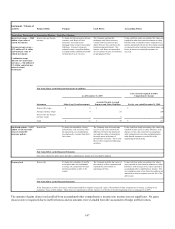

Note 13 — Derivative Financial Instruments

The Company’s investment strategy is to manage the characteristics of investment assets (such as duration, yield, currency and

liquidity) to meet the varying demands of the related insurance and contractholder liabilities (such as paying claims, investment

returns and withdrawals). As part of this investment strategy, the Company typically uses derivatives to minimize interest rate,

foreign currency and equity price risks. The Company routinely monitors exposure to credit risk associated with derivatives and

diversifies the portfolio among approved dealers of high credit quality to minimize credit risk. In addition, the Company has written

or sold contracts to guarantee minimum income benefits and, from time to time, to enhance investment returns.

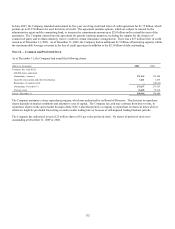

The Company uses hedge accounting when derivatives are designated, qualify and are highly effective as hedges. Effectiveness is

formally assessed and documented at inception and each period throughout the life of a hedge using various quantitative methods

appropriate for each hedge, including regression analysis and dollar offset. Under hedge accounting, the changes in fair value of the

derivative and the hedged risk are generally recognized together and offset each other when reported in shareholders’ net income.

The Company accounts for derivative instruments as follows:

x Derivatives are reported on the balance sheet at fair value with changes in fair values reported in net income or accumulated other

comprehensive income.

x Changes in the fair value of derivatives that hedge market risk related to future cash flows – and that qualify for hedge accounting

– are reported in a separate caption in accumulated other comprehensive income. These hedges are referred to as cash flow

hedges.

x A change in the fair value of a derivative instrument may not always equal the change in the fair value of the hedged item; this

difference is referred to as hedge ineffectiveness. Where hedge accounting is used, the Company reflects hedge ineffectiveness in

net income (generally as part of realized investment gains and losses).

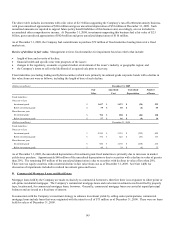

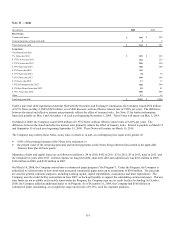

Certain subsidiaries of the Company are parties to over-the-counter derivative instruments that contain provisions requiring both

parties to such instruments to post collateral depending on net liability thresholds and the party’s financial strength or credit rating.

The collateral posting requirements vary by counterparty. The aggregate fair value of derivative instruments with such credit-risk-

related contingent features where subsidiaries of the Company were in a net liability position as of December 31, 2009 was $29

million for which the Company was not required to post collateral with its counterparties. If the various contingent features

underlying the agreements were triggered as of December 31, 2009, the Company would be required to post collateral equal to the

total net liability. Such subsidiaries are parties to certain other derivative instruments that contain termination provisions for which the

counterparties could demand immediate payment of the total net liability position if the financial strength rating of the subsidiary were

to decline below specified levels. As of December 31, 2009, there was no net liability position under such derivative instruments.

See Note 7 for a discussion of derivatives associated with GMDB contracts and Note 11 for a discussion of derivatives arising from

GMIB contracts.

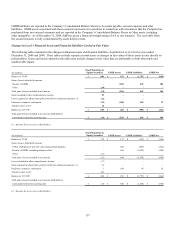

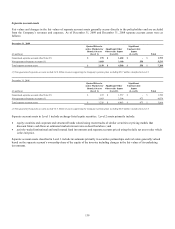

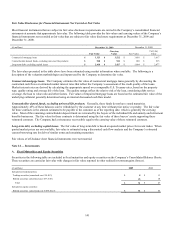

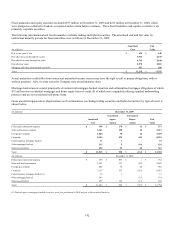

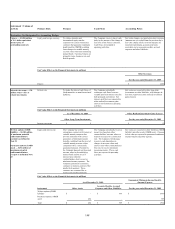

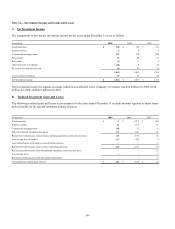

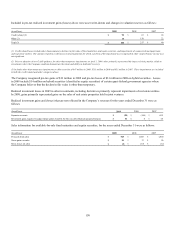

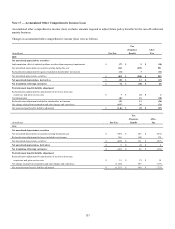

The table below presents information about the nature and accounting treatment of the Company’s primary derivative financial

instruments including the Company’s purpose for entering into specific derivative transactions, and their locations and effect on the

financial statements as of and for the period ended December 31, 2009. Derivatives in the Company’s separate accounts are not

included because associated gains and losses generally accrue directly to policyholders.