Cigna 2009 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

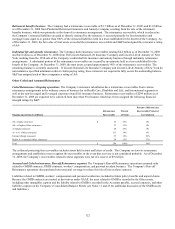

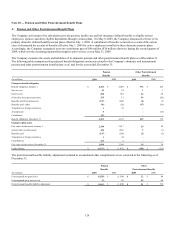

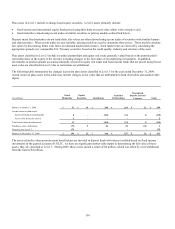

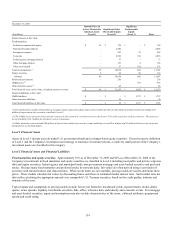

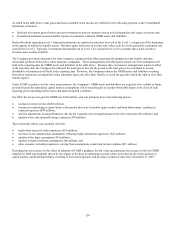

Assumptions for pension and other postretirement benefit plans. Management determined the present value of the projected benefit

obligation and the accumulated other postretirement benefit obligation and related benefit costs based on the following weighted

average assumptions as of and for the years ended December 31:

2009 2008

Discount rate:

Pension benefit obligation 5.50% 6.25%

Other postretirement benefit obligation 5.25% 6.25%

Pension benefit cost 6.25% 6.25%

Other postretirement benefit cost 6.25% 6.25%

Expected long-term return on plan assets:

Pension benefit cost 8.00% 8.00%

Other postretirement benefit cost 5.00% 5.00%

Expected rate of compensation increase:

Projected pension benefit obligation 3.50% 3.50%

Pension benefit cost 3.50% 3.50%

Other postretirement benefit obligation 3.00% 3.00%

Other postretirement benefit cost 3.00% 3.00%

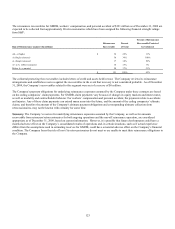

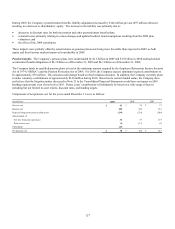

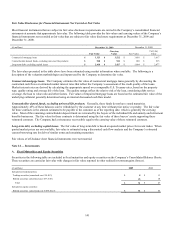

Discount rates are set by applying actual annualized yields at various durations from the Citigroup Pension Liability curve, without

adjustment, to the expected cash flows of the postretirement benefits liabilities. The Company believes that the Citigroup Pension

Liability curve is the most representative curve to use because it is derived from a broad array of bonds in various industries

throughout the domestic market for high quality bonds. Further, Citigroup monitors the bond portfolio to ensure that only high quality

issues are included. Accordingly, the Company does not believe that any adjustment is required to the Citigroup curve. Expected

long-term rates of return on plan assets were developed considering actual long-term historical returns, expected long-term market

conditions, plan asset mix and management’s investment strategy. Actual and target investment allocations are very similar at

December 31, 2009.

To measure pension costs, the Company uses a market-related asset valuation for domestic pension plan assets invested in non-fixed

income investments. The market-related value of pension assets recognizes the difference between actual and expected long-term

returns in the portfolio over 5 years, a method that reduces the short-term impact of market fluctuations. At December 31, 2009, the

market-related asset value was approximately $3.3 billion compared with a market value of approximately $2.9 billion.

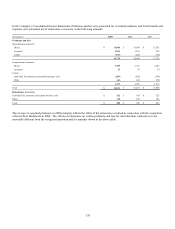

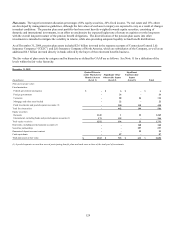

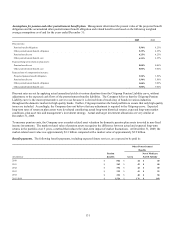

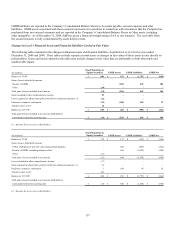

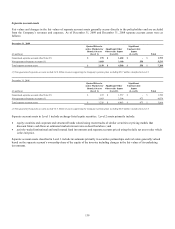

Benefit payments. The following benefit payments, including expected future services, are expected to be paid in:

Other Postretirement

Benefits

Pension Net of Medicare

(In millions) Benefits Gross Part D Subsidy

2010 $ 502 $ 44 $ 40

2011 $ 343 $ 42 $ 40

2012 $ 332 $ 42 $ 40

2013 $ 319 $ 41 $ 39

2014 $ 321 $ 40 $ 38

2015-2019 $ 1,526 $ 176 $ 169