Cigna 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

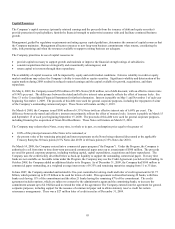

The Company had commitments to invest in limited liability entities that hold real estate, loans to real estate entities or securities.

See Note 12(C) to the Consolidated Financial Statements for additional information.

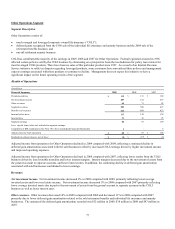

Future service commitments include an agreement with IBM for various information technology (IT) infrastructure services. The

Company's remaining commitment under this contract is approximately $376 million over the next four years. The Company has

the ability to terminate this agreement with 90 days notice, subject to termination fees.

The Company's remaining estimated future service commitments primarily represent contracts for certain outsourced business

processes and IT maintenance and support. The Company generally has the ability to terminate these agreements, but does not

anticipate doing so at this time. Purchase obligations exclude contracts that are cancelable without penalty or those that do not

specify minimum levels of goods or services to be purchased.

x Operating leases. For additional information, see Note 21 to the Consolidated Financial Statements.

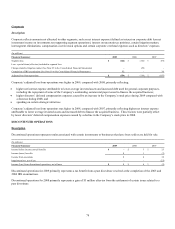

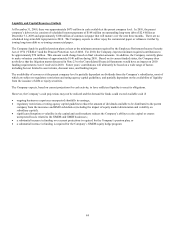

Guarantees

The Company, through its subsidiaries, is contingently liable for various financial and other guarantees provided in the ordinary

course of business. See Note 23 to the Consolidated Financial Statements for additional information on guarantees.

Share Repurchase

The Company maintains a share repurchase program, which was authorized by its Board of Directors. The decision to repurchase

shares depends on market conditions and alternative uses of capital. The Company has, and may continue from time to time, to

repurchase shares on the open market through a Rule 10b5-1 plan which permits a company to repurchase its shares at times when it

otherwise might be precluded from doing so under insider trading laws or because of self-imposed trading blackout periods.

The Company did not repurchase any shares in 2009. In 2008 the Company repurchased 10.0 million shares for $378 million.

The total remaining share repurchase authorization as of February 25, 2010, was $449 million.

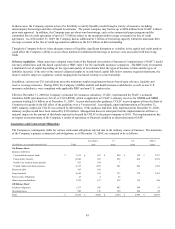

INVESTMENT ASSETS

The Company’s investment assets do not include separate account assets. Additional information regarding the Company’s

investment assets and related accounting policies is included in Notes 2, 11, 12, 14 and 17 to the Consolidated Financial Statements.

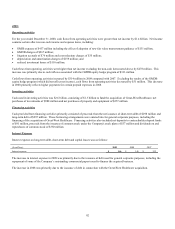

Fixed Maturities

Investments in fixed maturities (bonds) include publicly traded and privately placed debt securities, mortgage and other asset-backed

securities, preferred stocks redeemable by the investor and trading securities. Fixed maturities and equity securities include hybrid

securities. Fair values are based on quoted market prices when available. When market prices are not available, fair value is generally

estimated using discounted cash flow analyses, incorporating current market inputs for similar financial instruments with comparable

terms and credit quality. In instances where there is little or no market activity for the same or similar instruments, the Company

estimates fair value using methods, models and assumptions that the Company believes a hypothetical market participant would use to

determine a current transaction price.

The Company performs ongoing analyses on prices to conclude that they represent reasonable estimates of fair value. This process

involves quantitative and qualitative analysis and is overseen by the Company’s investment professionals. This process also includes

review of pricing methodologies, pricing statistics and trends and back testing recent trades.

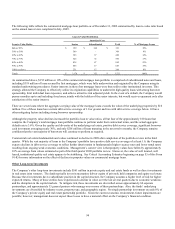

The Company’s fixed maturity portfolio continues to be diversified by issuer and industry type, with no single industry constituting

more than 10% of total invested assets as of December 31, 2009.