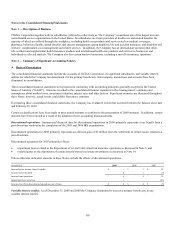

Cigna 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

CAUTIONARY STATEMENT FOR PURPOSES OF THE “SAFE HARBOR” PROVISIONS OF THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

CIGNA Corporation and its subsidiaries (the “Company”) and its representatives may from time to time make written and oral forward-

looking statements, including statements contained in press releases, in the Company’s filings with the Securities and Exchange

Commission, in its reports to shareholders and in meetings with analysts and investors. Forward-looking statements may contain

information about financial prospects, economic conditions, trends and other uncertainties. These forward-looking statements are based

on management’s beliefs and assumptions and on information available to management at the time the statements are or were made.

Forward-looking statements include but are not limited to the information concerning possible or assumed future business strategies,

financing plans, competitive position, potential growth opportunities, potential operating performance improvements, trends and, in

particular, the Company’s productivity initiatives, litigation and other legal matters, operational improvement initiatives in the health

care operations, and the outlook for the Company’s results for full year 2010 and beyond. Forward-looking statements include all

statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe”,

“expect”, “plan”, “intend”, “anticipate”, “estimate”, “predict”, “potential”, “may”, “should” or similar expressions.

You should not place undue reliance on these forward-looking statements. The Company cautions that actual results could differ

materially from those that management expects, depending on the outcome of certain factors. Some factors that could cause actual

results to differ materially from the forward-looking statements include:

1. increased medical costs that are higher than anticipated in establishing premium rates in the Company’s health care operations,

including increased use and costs of medical services;

2. increased medical, administrative, technology or other costs resulting from new legislative and regulatory requirements imposed

on the Company’s employee benefits businesses;

3. challenges and risks associated with implementing operational improvement initiatives and strategic actions in the ongoing

operations of the businesses, including those related to: (i) growth in targeted geographies, product lines, buying segments and

distribution channels, (ii) offering products that meet emerging market needs, (iii) strengthening underwriting and pricing

effectiveness, (iv) strengthening medical cost and medical membership results, (v) delivering quality member and provider

service using effective technology solutions, (vi) lowering administrative costs and (vii) transitioning to an integrated operating

company model, including operating efficiencies related to the transition;

4. risks associated with pending and potential state and federal class action lawsuits, disputes regarding reinsurance arrangements,

other litigation and regulatory actions challenging the Company’s businesses, including disputes related to payments to providers,

government investigations and proceedings, and tax audits and related litigation;

5. heightened competition, particularly price competition, which could reduce product margins and constrain growth in the

Company’s businesses, primarily the Health Care business;

6. risks associated with the Company’s mail order pharmacy business which, among other things, includes any potential operational

deficiencies or service issues as well as loss or suspension of state pharmacy licenses;

7. significant changes in interest rates and deterioration in the loan to value ratios of commercial real estate investments for a

sustained period of time;

8. downgrades in the financial strength ratings of the Company’s insurance subsidiaries, which could, among other things, adversely

affect new sales and retention of current business as well as the downgrade in the financial strength ratings of reinsurers which

could result in increased statutory reserve or capital requirements;

9. limitations on the ability of the Company’s insurance subsidiaries to dividend capital to the parent company as a result of

downgrades in the subsidiaries’ financial strength ratings, changes in statutory reserve or capital requirements or other financial

constraints;

10. the inability of the hedge program adopted by the Company to substantially reduce equity market risks for reinsurance contracts

that guarantee minimum death benefits under certain variable annuities (including possible market difficulties in entering into

appropriate futures contracts and in matching such contracts to the underlying equity risk);

11. adjustments to the reserve assumptions (including lapse, partial surrender, mortality, interest rates and volatility) used in

estimating the Company’s liabilities for reinsurance contracts covering guaranteed minimum death benefits under certain variable

annuities;

12. adjustments to the assumptions (including annuity election rates and amounts collectible from reinsurers) used in estimating the

Company’s assets and liabilities for reinsurance contracts covering guaranteed minimum income benefits under certain variable

annuities;

13. significant stock market declines, which could, among other things, result in increased expenses for guaranteed minimum income

benefit contracts, guaranteed minimum death benefit contracts and the Company’s pension plan in future periods as well as the

recognition of additional pension obligations;

14. unfavorable claims experience related to workers’ compensation and personal accident exposures of the run-off reinsurance

business, including losses attributable to the inability to recover claims from retrocessionaires;