Cigna 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

Notes to the Consolidated Financial Statements

Note 1 — Description of Business

CIGNA Corporation together with its subsidiaries (referred to collectively as “the Company”) constitutes one of the largest investor-

owned health service organizations in the United States. Its subsidiaries are major providers of health care and related benefits, the

majority of which are offered through the workplace, including health care products and services such as medical coverages,

pharmacy, behavioral health, dental benefits, and disease management; group disability, life and accident insurance; and disability and

workers’ compensation case management and related services. In addition, the Company has an international operation that offers

life, accident and supplemental health insurance products and international health care products and services to businesses and

individuals in selected markets. The Company also has certain inactive businesses, including a run-off reinsurance operation.

Note 2 — Summary of Significant Accounting Policies

A. Basis of Presentation

The consolidated financial statements include the accounts of CIGNA Corporation, its significant subsidiaries, and variable interest

entities for which the Company has determined it is the primary beneficiary. Intercompany transactions and accounts have been

eliminated in consolidation.

These consolidated financial statements were prepared in conformity with accounting principles generally accepted in the United

States of America (“GAAP”). Amounts recorded in the consolidated financial statements reflect management’s estimates and

assumptions about medical costs, investment valuation, interest rates and other factors. Significant estimates are discussed throughout

these Notes; however, actual results could differ from those estimates.

In preparing these consolidated financial statements, the Company has evaluated events that occurred between the balance sheet date

and February 25, 2010.

Certain reclassifications have been made to prior period amounts to conform to the presentation of 2009 amounts. In addition, certain

amounts have been restated as a result of the adoption of new accounting pronouncements.

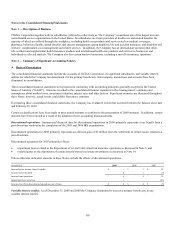

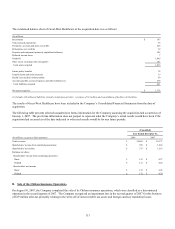

Discontinued operations. Summarized financial data for discontinued operations in 2009 primarily represents a tax benefit from a

past divestiture resolved at the completion of the 2005 and 2006 IRS examinations.

Discontinued operations for 2008 primarily represents an after-tax gain of $3 million from the settlement of certain issues related to a

past divestiture.

Discontinued operations for 2007 primarily reflects:

x impairment losses related to the dispositions of several Latin American insurance operations as discussed in Note 3; and

x realized gains on the disposition of certain directly-owned real estate investments as discussed in Note 14.

Unless otherwise indicated, amounts in these Notes exclude the effects of discontinued operations.

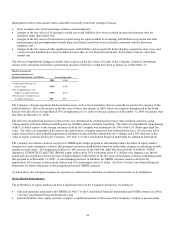

(In millions) 2009 2008 2007

Income before income (taxes) benefits $ - $ 3 $ 25

Income (taxes) benefits 1 1 (7)

Income from operations 1 4 18

Impairment loss, net of tax - - (23)

Income (loss) from discontinued operations, net of taxes $ 1 $ 4 $(5)

Variable interest entities. As of December 31, 2009 and 2008 the Company determined it was not a primary beneficiary in any

variable interest entities.