BMW 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

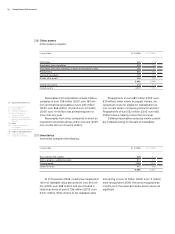

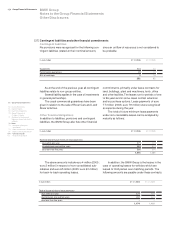

The main assumptions, in addition to life expectancy,

depend on the economic situation in each particular

country. The following weighted average values are

used in the United Kingdom (UK) and in the other

countries:

95

The salary level trend refers to the expected rate

of salary increase which is estimated annually de-

pending on inflation and the period of service of em-

ployees with the Group.

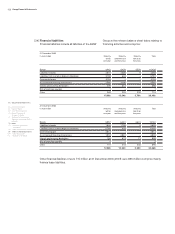

In the case of funded plans, the defined benefit

obligation is offset against plan assets measured at

their fair value. Where the plan assets exceed the

pension obligations and the enterprise has a right of

reimbursement or a right to reduce future contribu-

tions, the surplus amount is recognised in accor-

dance with IAS 19 as an asset under other assets. In

the case of funded pension plans, a liability is recog-

nised under pension provisions where the benefit

obligation exceeds fund assets.

Actuarial gains or losses may result from

in-

creases or decreases in either the present value of

the defined benefit obligation or in the fair value of

the plan assets. Causes of actuarial gains or losses

include the effect of changes in the measurement

parameters, changes in estimates caused by the

actual development of risks impacting on pension

obligations and differences between the actual and

expected return on plan assets. Past service cost

arises where a BMW Group company introduces a

defined benefit plan or changes the benefits payable

under an existing plan.

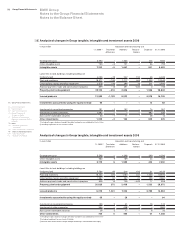

Based on the measurement principles con-

tained

in IAS 19, the following funding status applies

to the Group’s pension plans:

in % Germany UK Other

31 December 2006 2005 2006 2005 2006 2005

in euro million Germany UK Other Total

31 December 2006 2005 2006 2005 2006 2005 2006 2005

Discount rate 4.40 4.25 5.11 4.72 5.19 5.28

Salary level trend 3.25 3.25 4.12 3.86 2.59 2.62

Pension level trend 1.75 1.75 3.09 2.83 1.79 1.89

Present value of pension benefits covered by

accounting provisions 4,412 4,234 ––134 112 4,546 4,346

Present value of funded pension benefits – –6,568 6,576 316 315 6,884 6,891

Defined benefit obligations 4,412 4,234 6,568 6,576 450 427 11,430 11,237

Fair value of plan assets – –6,134 5,784 298 233 6,432 6,017

Net obligation 4,412 4,234 434 792 152 194 4,998 5,220

Income (+) expense (–) from past service cost

not yet recognised – –––1–2 1–2

Amount not recognised as an asset because of

the limit in IAS 19.58 – –5–11 10 16 10

Balance sheet amount at 31.12. 4,412 4,234 439 792 164 202 5,015 5,228

thereof pension provision 4,412 4,234 440 819 165 202 5,017 5,255

thereof pension asset (–) – ––1 –27 –1 ––2 –27

Pension provisions relating to pension plans in

other countries amounted to euro 165 million (2005:

euro 202 million).This includes euro 80 million (2005:

euro 82 million) relating to externally funded plans.