BMW 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 Group Financial Statements

65 Group Financial Statements

65 Income Statements

66 Balance Sheets

68 Cash Flow Statements

70 Group Statement of

Changes in Equity

71 Statement of Income and

Expenses recognised directly

in Equity

72 Notes

72 – Accounting Principles

and Policies

79 – Notes to the Income Statement

86 – Notes to the Balance Sheet

104 – Other Disclosures

111 – Segment Information

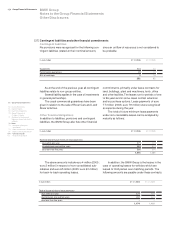

These interest rates were adjusted, where

necessary, to take account of the credit quality and

risk of the underlying financial instrument.

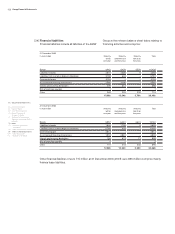

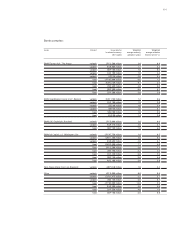

The nominal amounts of derivative financial

instruments correspond to the purchase or sale

amounts or contract values of the underlying trans-

actions. The nominal amounts, fair values (and also

carrying amounts) and maturities of derivative finan-

cial instruments of the BMW Group are shown in

the following analysis:

The disclosed fair values of derivative financial

instruments, based on their nominal amounts, do

not take account of any compensating changes in

the value of the underlying transaction. Moreover,

the fair values disclosed do not necessarily corre-

spond to the amounts which the BMW Group will

realise in the future under the market conditions pre-

vailing at that time.

The currency hedge contracts comprise princi-

pally options and forward currency contracts which

are designated as a cash flow hedge. The interest

rate contracts include swaps which are accounted

for on the basis of whether they are designated as a

fair value hedge or as a cash flow hedge.

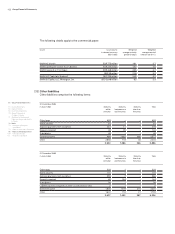

The fair values of financial instruments relating

to hedged forecast transactions and available-for-

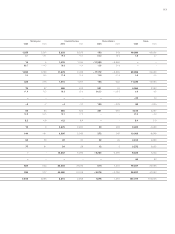

in euro million Nominal Fair values

amount

Total due within due between duelater

one year one and than

five years five years

31 December 2006

Assets

Currency hedge contracts 15,567 618 572 46 –

Interest rate contracts 13,411 658 55 468 135

Other derivative instruments 172 45 39 6 –

Total 29,150 1,321 666 520 135

Liabilities

Currency hedge contracts 9,350 427 269 158 –

Interest rate contracts 3,479 73 10 63 –

Other derivative instruments 209 96 – 96 –

Total 13,038 596 279 317 –

31 December 2005

Assets

Currency hedge contracts 6,378 270 163 107 –

Interest rate contracts 11,975 488 41 315 132

Other derivative instruments 209 48 21 27 –

Total 18,562 806 225 449 132

Liabilities

Currency hedge contracts 14,509 361 154 207 –

Interest rate contracts 5,792 36 2 13 21

Other derivative instruments 561 453 – 453 –

Total 20,862 850 156 673 21