BMW 2006 Annual Report Download - page 95

Download and view the complete annual report

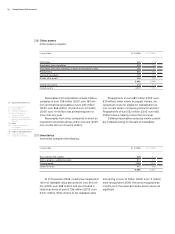

Please find page 95 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reduced by the payment of the dividend for 2005

amounting to euro 419 million. As a result of the

withdrawal of treasury shares from circulation,

revenues reserves decreased by euro 679 million.

The unappropriated profit of BMW AG of euro

458 million for 2006 will be proposed to the Annual

General Meeting for distribution. A tax reimburse-

ment claim of euro 12 million arose in 2006 in con-

junction with the corporation tax system applicable

until 2001.

As a consequence of new German tax legislation

relating to transitional taxation measures enacted

in conjunction with the introduction of the European

company and other changes in tax regulations, the

BMW AG’s ability to recover tax reduction claims

of

euro 156 million arising from the previous corpo-

ration tax system are no longer linked to actual distri-

butions. The corporation tax credit will now be

dis-

bursed in ten equal instalments over a ten-year period

between 2008 and 2017. The present value of the

tax reimbursement receivable amounted to euro

123 million and has been recognised in full as

an

asset.

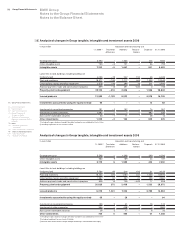

Accumulated other equity

Accumulated other equity consists of all amounts

recognised directly in equity resulting from the trans-

lation of the financial statements of foreign sub-

sidiaries, the effects of recognising changes in the

fair value of financial instruments directly in equity

as well as actuarial gains and losses relating to de-

fined benefit pension plans and similar obligations.

Accumulated other equity was increased by de-

ferred taxes amounting to euro 512 million (2005:

euro 727 million) recognised directly in equity.

Minority interest

The minority interest in the equity of subsidiaries

amounted to euro 4 million (2005: euro 0.188 million).

This includes a minority interest of euro 6 million

(2005: euro 0.098 million) in subsidiaries’ results for

the year.

94 Group Financial Statements

65 Group Financial Statements

65 Income Statements

66 Balance Sheets

68 Cash Flow Statements

70 Group Statement of

Changes in Equity

71 Statement of Income and

Expenses recognised directly

in Equity

72 Notes

72 – Accounting Principles

and Policies

79 – Notes to the Income Statement

86 – Notes to the Balance Sheet

104 – Other Disclosures

111 – Segment Information

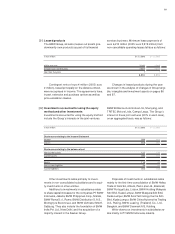

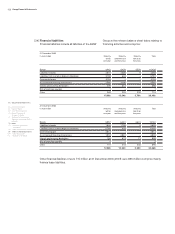

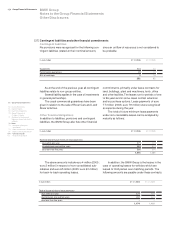

Pension provisions

Pension provisions are recognised as a result of com-

mitments to pay future vested pension benefits and

current pensions to present and former employees

of the BMW Group and their surviving dependants.

Depending on the legal, economic and tax circum-

stances prevailing in each country, various pension

plans are used, based generally on the length of

service and salary of employees. Due to similarity

of nature, the obligations of BMW Group companies

in the U.S. and of BMW (South Africa) (Pty) Ltd.,

Pretoria, for post-employment medical care are also

disclosed as pension provisions. The provision for

these pension-like obligations amounts to euro 49

million (2005: euro 43 million) and is measured, simi-

lar to pension obligations, in accordance with IAS19.

In the case of post-employment medical care, it is

assumed that costs will increase on a long-term basis

by 6% p.a. (unchanged from the previous year).

The expense for medical care costs in the financial

year 2006 amounted to euro 6 million (2005: euro

8 million).

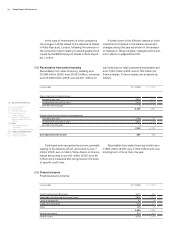

Post-employment benefit plans are classified as

either defined contribution or defined benefit plans.

Under defined contribution plans, an enterprise pays

fixed contributions into a separate entity or fund and

does not assume any other obligations. The total

pension expense for all defined contribution plans

of the BMW Group amounts to euro 409 million

(2005: euro 400 million). This includes employer

contributions paid to state pension insurance

schemes amounting to euro 388 million (2005: euro

381 million).

Under defined benefit plans, the enterprise is

required to pay the benefits granted to present and

past employees. Defined benefit plans may be fund-

ed or unfunded, the latter sometimes financed by

means of accounting provisions. Most of the pen-

sion commitments of the BMW Group in Germany

relate to BMW AG, whose pension plans, like all

those of all of the BMW Group’s German subsidiaries,

are unfunded and financed by means of accounting

provisions. In addition, a deferred remuneration re-

tirement scheme is in place which is funded by em-

ployee contributions. The main funded plans of the

BMW Group are in the United Kingdom, the USA,

Switzerland, the Netherlands, Belgium and Japan.

Pension obligations are computed on an actuar-

ial basis at the level of the defined benefit obligation.

This computation requires the use of estimates.

[31]