BMW 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business environment

Economic developments in 2006

The global economy grew strongly again in 2006.

For the most part, growth rates were even higher

than in the previous year despite the greater impact

of adverse factors. Higher interest rates worldwide

and further hikes in the price of crude oil and other

raw materials were the main reasons for higher

costs for businesses and the further reduction in

consumer buying power.

The US economy grew at a rate of 3.3% in

2006. It was initially able to maintain its role as the

motor for the global economy but, since the sum-

mer, there has been a noticeable deceleration in the

pace of growth. Amongst other factors, the sharp

rise in interest rate levels slowed down the property

boom. By contrast, the unemployment situation

had

improved by the end of the year. In general, pri-

vate consumption continued to provide momentum,

whereas investments were significantly down. Ex-

ports again failed to contribute to growth, with the

current account deficit refusing to shift from a level

of well over 6% of gross domestic product.

In the euro region, gross domestic product grew

strongly by 2.7% in 2006, performing dynamically

again for the first time in years. The main factors

contributing to this development were continuing

high investment levels and rising private consumer

expenditure. Overall, however, despite the sharp

growth in exports, the current account for the euro

region was still negative.The improved performance

tailed off slightly towards the year-end.

The German economy grew by 2.5% in 2006.

In addition to the continuing boom in investments

and exports, after a considerable absence, consumer

expenditure edged up, to a large extent brought

forward into 2006 in the light of the

value added tax

increase at the beginning of 2007. On top of that,

the construction industry was able to overcome the

crisis it has been facing ever since reunification and,

once again, make a positive contribution to growth.

The economies of new EU member states

again performed well in 2006.This was under-

pinned in all of the countries involved by very

dynamic export performances and robust domes-

tic economies.

In 2006, the Japanese economy grew at

about

2%, matching the previous year’s growth

rate and confirming the end of a long weak phase.

The sources of growth in 2006 were well-balanced,

driven by both domestic and export factors; gradu-

ally, deflationary trends also appear to have been

overcome.

The emerging Asian countries again registered

the strongest growth rates in 2006. While the Indian

economy expanded by more than 8%, the Chinese

gross domestic product again grew at a rate in ex-

cess of 10%. South-East Asian economies grew

on average by approximately 5.5%.

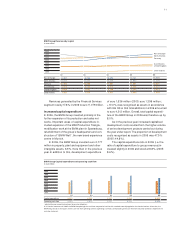

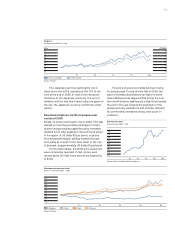

US dollar loses value over course of year

The US dollar again lost value against the euro over

the course of 2006. Compared to an exchange rate

of US dollar 1.18 to the euro at the beginning of the

year, the US currency slipped to a rate of over US

dollar 1.33 to the euro over the course of the year,

finishing at US dollar 1.32 to the euro and therefore

11.9% weaker than at the beginning of the year.

Although the British pound remained within its

longstanding range of GBP 0.70 and 0.67 to the

euro, it has shown signs of strengthening since the

middle of the year.

General Economic Environment

Exchange rates compared to the Euro

(Index: 31 December 2001 = 100)

170

160

150

140

130

120

110

100

90

02 03 04 05 06

US Dollar

Source: Reuters

Japanese Yen British Pound

12 Group Management Report

10 Group Management Report

10 A Review of the Financial Year

12

General EconomicEnvironment

15 Review of operations

38 BMW Stock and Bonds

41 Disclosures pursuant to §289 (4)

and §315 (4) HGB

43 Financial Analysis

43 – Internal Management System

44 – Earnings performance

46 – Financial position

48 – Net assets position

50 – Subsequent events report

50 – Value added statement

53 – Key performance figures

54 – Comments on BMW AG

58 Risk Management

62 Outlook