BMW 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

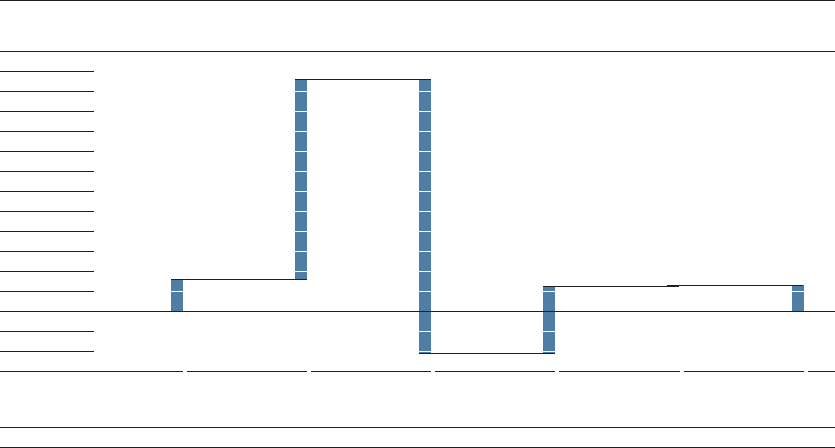

Operating activities of the BMW Group generated

a positive cash flow of euro 9,980 million in 2006,

down by euro 711 million or 6.7% compared to one

year earlier. Changes in net current assets during

2006 resulted in a net cash outflow of euro 49 million

(2005: net inflow of euro 923 million). The net cash

outflow was due to the higher level of inventories.

The cash outflow for investing activities

amounted to euro 13,670 million and was therefore

euro 1,707 million higher than in 2005. The marked

increase in cash outflow for investing activities was

due, on the one hand, to increased capital expendi-

ture in 2006 and, on the other, to the receipt, in 2005,

of the final sales price instalment of euro 1,000 million

from the sale of Land Rover. Capital expenditure on

intangible assets and property, plant and equipment

resulted in the cash outflow for investing activities

increasing by euro 438 million compared to the pre-

vious year. The cash outflow for net investments in

financial services activities also rose steeply and was

euro 505 million higher than in the previous year.

Financing activities in 2006 generated a

posi-

tive cash flow of euro 3,323 million (2005: euro

699

million). Cash inflows from the issue of bonds

totalled euro 6,876 million (2005: euro 5,819 million),

whilst cash outflows to repay bonds totalled euro

4,491 million (2005: euro 3,432 million). The dividend

payment made during the financial year 2006 was

euro 419 million. The share buy-back programme

involved a cash outflow in 2006 of euro 253 million.

73.0% (2005: 89.4 %) of the cash outflow for

investing activities was covered by the cash inflow

from operating activities.

The cash flow statement for Industrial opera-

tions shows that the cash inflow from operating

activities exceeded the cash outflow for investing

activities by 21.6 % (2005:150.7%). By contrast, the

cash flow statement for Financial operations shows

that, due to the high level of capital expenditure on

leased products and receivables from sales financing,

the cash inflow from operating activities did not cover

the cash outflow for investing activities. The short

fall was 50.2% (2005: 52.5%).

After adjustment for the effects of exchange-

rate fluctuations and changes in the composition of

the BMW Group which resulted in a positive amount

of euro 82 million (2005: euro 66 million), the various

cash flows resulted in a decrease in cash and cash

Change in cash and cash equivalents

in euro million

12,000

11,000

10,000

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

–1,000

–2,000

Cash and cash

equivalents

31.12.2005

1,621

Cash inflow from

operating activities

+9,980

Cash outflow from

investing activities

–13,670

Cash inflow from

financing activities

+ 3,323

Currency trans-

lation, changes in

group composition

+82

Cash and cash

equivalents

31.12.2006

1,336