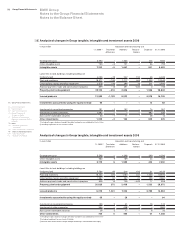

BMW 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.78 Group Financial Statements

65 Group Financial Statements

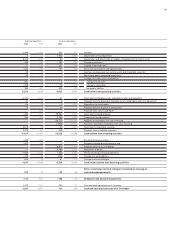

65 Income Statements

66 Balance Sheets

68 Cash Flow Statements

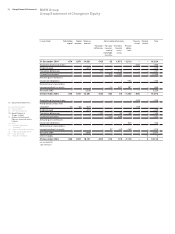

70 Group Statement of

Changes in Equity

71 Statement of Income and

Expenses recognised directly

in Equity

72 Notes

72 – Accounting Principles

and Policies

79 – Notes to the Income Statement

86 – Notes to the Balance Sheet

104 – Other Disclosures

111 – Segment Information

Financing costs are not included in acquisition

or manufacturing cost.

Provisions for pensions and similar obligations are

recognised using the projected unit credit method in

accordance with IAS 19 (Employee Benefits). Under

this method, not only obligations relating to known

vested benefits at the reporting date are recognised,

but also the effect of future increases in pensions

and salaries. This involves taking account of various

input factors which are evaluated on a prudent basis.

The provision is derived from an independent actu-

arial valuation which takes into account the relevant

biometric factors.

Actuarial gains and losses are recognised, net of

deferred tax, directly in equity.

The expense related to the reversal of discount-

ing on pension obligations and the income from the

expected return on pension plan assets are reported

separately as part of the financial result. All other costs

relating to allocations to pension provisions are allo-

cated to costs by function in the income statement.

Other provisions are recognised when the Group

has an obligation to a third party, an outflow of re-

sources is probable and a reliable estimate can be

made of the amount of the obligation. Measurement

is computed on the basis of fully attributable costs.

Non-current provisions with a remaining period of

more than one year are discounted to the present

value of the expenditures expected to settle the

obligation at the balance sheet date.

Financial liabilities are measured on first-time

recognition at cost, which is equivalent to the fair

value of the consideration given. Transaction costs

are included in this initial measurement. Subse-

quent to initial recognition, liabilities are, with the

exception of derivative financial instruments, meas-

ured at amortised cost. The BMW Group has no

liabilities which are held for trading. Liabilities from

finance leases are stated at the present value of

the future lease payments and disclosed under finan-

cial liabilities.

The preparation of the Group financial state-

ments in accordance with IFRSs requires manage-

ment to make certain assumptions and estimates

that affect the reported amounts of assets and lia-

bilities, revenues and expenses and contingent

liabilities. The assumptions and estimates relate

principally to the group-wide determination of eco-

nomic useful lives, the recognition and measure-

ment of provisions and the recoverability of future

taxbenefits. Actual amounts could in certain cases

differ from those assumptions and estimates.

Where

new information comes to light, differences

are reflected in the income statement.

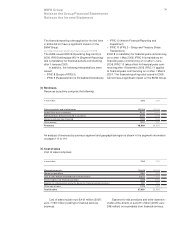

New financial reporting rules

(a) Financial reporting rules applied for the first time

in the financial year 2006

The following revised financial reporting standards

were applied for the first time in the financial year

2006:

– Amendments to IAS 39 and IFRS 4 (Financial

Guarantee Contracts)

– Amendment to IAS 21 (Effects of Changes in

Foreign Exchange Rates)

In addition, the following Interpretations were applied

for the first time:

–IFRIC 4 (Determining whether an Arrangement

contains a Lease)

–IFRIC 5 (Rights to Interests arising from Decom-

missioning, Restoration and Environmental

Rehabilitation Funds)

–IFRIC 6 (Liabilities arising from Participating in a

Specific Market – Waste Electrical and Electronic

Equipment)

[7]