BMW 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10 Group Management Report

10 Group Management Report

10 A Review of the Financial Year

12

General EconomicEnvironment

15 Review of operations

38 BMW Stock and Bonds

41 Disclosures pursuant to §289 (4)

and §315 (4) HGB

43 Financial Analysis

43 – Internal Management System

44 – Earnings performance

46 – Financial position

48 – Net assets position

50 – Subsequent events report

50 – Value added statement

53 – Key performance figures

54 – Comments on BMW AG

58 Risk Management

62 Outlook

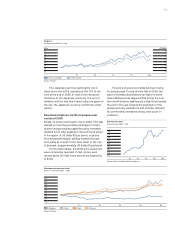

BMW Group reports the most successful year

in its corporate history

The BMW Group achieved record levels for sales

volume, revenues and earnings in 2006.The past year

has therefore been the most successful in the Group’s

corporate history. In spite of adverse effects from

foreign exchange and high raw material prices hold-

ing down the increase in reported results, the BMW

Group was able to achieve, and in some areas do

even better than the targets it had set itself for 2006.

Within the automobile line of business, the total

number of BMW, MINI and Rolls-Royce brand cars

sold increased by 3.5% to a total of 1,373,970 vehi-

cles. The anticipated seasonal effect, caused by

base effects during the first half of the year and by

numerous model life-cycle factors over the course

of the year, was evident. This caused the sales

volume to increase significantly more sharply during

the first half of year than in the second half.

Within the motorcycles line of business, the

efficiency improvement measures initiated in 2005

started taking effect, bringing about the desired

improvement in competitiveness. For the first time

in its corporate history, more than 100,000 BMW

motorcycles were manufactured and sold in a single

year.

The financial services business remained on

growth course in 2006. On the one hand, higher

interest rates and the related increase in refinancing

costs had the expected adverse impact on reported

results. However, by optimising processes, expanding

the range of products and increasing regional cover-

age, it was possible to implement suitable measures

to counter the adverse impact.

Reconciliations to group profit were again in-

fluenced significantly by external factors in 2006, in

particular by the impact of the exchangeable bond

option relating to the BMW Group investment in

Rolls-Royce plc, London. In 2005, the bond had

given rise to fair value losses of euro 356 million. By

contrast, the exchangeable bond gave rise to an

accounting gain of euro 372 million in 2006, which

had a positive impact on reconciliations to group

profit and thus to the earnings of the BMW Group

for the year.

Sharp increase in earnings

Profit before tax surpassed the euro 4 billion level

for the first time in 2006. At euro 4,124 million, the

previous year’s figure was exceeded by 25.5%. Even

excluding the impact of the exchangeable bond re-

lating to the BMW Group investment in Rolls-Royce

plc, London, profit before tax improved by 3.0 % com-

pared

to the previous year.

The adverse effects from foreign exchange and

high raw material prices were felt most by the Auto-

mobiles segment. The segment profit, at euro

3,012 million, was nevertheless up by 1.2% over

the previous year.

The profit before tax of the Motorcycles seg-

ment rose by 10.0% to euro 66 million. The main

factors behind this positive development were the

process optimisation and efficiency improvement

measures initiated in the previous year.

Earnings of the Financial Services segment

continued to develop well on the back of unabated

growth. Segment profit before tax amounted to euro

685 million, surpassing the previous year’s figure by

13.2%.

As a result of various positive tax factors, in

particular in Germany, the effective tax rate of the

BMW Group in 2006, at 30.3%, was just below the

previous year’s level (31.9%).

The group net profit for 2006, at euro 2,874 mil-

lion, was also at a new high level.The previous year’s

figure was surpassed by 28.4 %.

Increased dividend proposed

The Board of Management and Supervisory Board

propose to the Annual General Meeting to use the

unappropriated profit available for distribution in

BMW AG amounting to euro 458 million, to pay a

dividend of euro 0.70 for each share of common

stock (2005: euro 0.64), an increase of 9.4% over

the previous year and euro 0.72 for each share of

preferred stock, an increase of 9.1% over the pre-

vious year (2005: euro 0.66).

Revenues at new high level

The good sales volume performance and the con-

tinued strong growth of financial services business

resulted in a sharp increase in group revenues.

These rose in 2006 by 5.0% to euro 48,999 million.

Excluding currency fluctuations, group revenues

would have increased by 5.5%.

Revenues generated by the Automobiles seg-

ment grew by 4.2% in 2006 to reach euro 47,767

million, therefore increasing marginally faster than

sales volume.

Revenues generated by the Motorcycles seg-

ment in 2006 were up by 3.4% compared to the

previous year, reaching a total of euro 1,265 million.

The current product initiative again had a positive

impact on segment revenues.

Group Management Report

A Review of the Financial Year