BMW 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

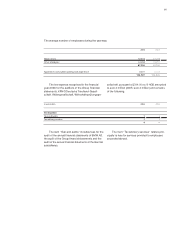

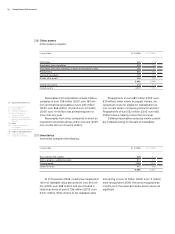

Other investments relate primarily to invest-

ments in non-consolidated subsidiaries and to equi-

ty investments in other entities.

Additions to investments in subsidiaries relate

to share capital increases for the companies PT BMW

Indonesia, Jakarta, BMW Philippines Corp., Manila,

BMW Roma S.r.l., Rome, BMW Distribution S.A.S.,

Montigny le Bretonneux, and BMW Vertriebs GmbH,

Salzburg. They also include the foundation of BMW

India Pvt. Ltd., New Delhi, and the acquisition of a

majority interest in the Sauber Group.

Disposals of investments in subsidiaries relate

mainly to the first-time consolidation of BMW Hellas

Trade of Cars SA, Athens, Park Lane Ltd., Bracknell,

BMW Portugal Lda., Lisbon, BMW Holding Malaysia

Sdn Bhd, Kuala Lumpur, BMW Malaysia Sdn Bhd,

Kuala Lumpur, BMW Asia Technology Centre Sdn

Bhd, Kuala Lumpur, BMW China Automotive Trading

Ltd., Peking, BMW Leasing (Thailand) Co., Ltd.,

Bangkok, and BMW Danmark A/S, Kolding.

Write-downs on investments in subsidiaries re-

late mainly to PT BMW Indonesia, Jakarta.

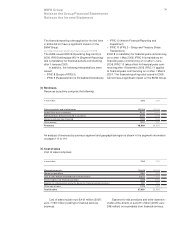

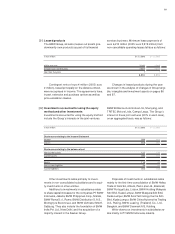

Leased products

The BMW Group, as lessor, leases out assets (pre-

dominantly own products) as part of its financial

services business. Minimum lease payments of

euro

6,210 million (2005: euro 5,919 million) from

non-cancellable operating leases fall due as follows:

Contingent rents of euro 4 million (2005: euro

2

million), based principally on the distance driven,

were recognised in income. The agreements have,

in part, extension and purchase options as well as

price escalation clauses.

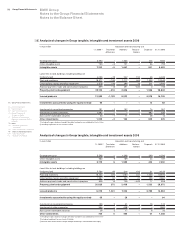

Changes in leased products during the year

are

shown in the analysis of changes in Group tangi-

ble, intangible and investment assets on pages 86

and 87.

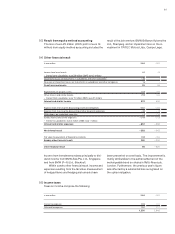

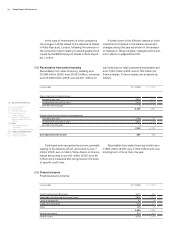

Investments accounted for using the equity

method and other investments

Investments accounted for using the equity method

include the Group’s interests in the joint ventures

BMW Brilliance Automotive Ltd., Shenyang, and

TRITEC Motors Ltda., Campo Largo. The Group’s

interest in these joint ventures (50% in each case),

on an aggregated basis, was as follows:

89

in euro million 31.12.2006 31.12.2005

in euro million 31.12.2006 31.12.2005

within one year 3,342 2,908

between one and five years 2,867 3,010

later than five years 1 1

6,210 5,919

Disclosures relating to the Income Statement

Income 589 463

Losses 568 461

Disclosures relating to the balance sheet

Non-current assets 122 134

Current assets 286 215

Equity 110 99

Non-current liabilities 34 85

Current liabilities 264 165

[21]

[22]