BMW 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.93

Trade accounts receivable

Trade receivables amounting in total to euro 2,258

million (2005: euro 2,135 million) include euro 21 mil-

lion

due later than one year (2005: all due within

one year).

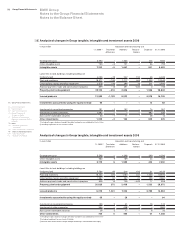

Equity

The Group Statement of Changes in Equity is

shown on page 70.

Number of shares issued

At 31 December 2006, common stock issued by

BMW AG was divided into 601,995,196 shares with

a par-value of one euro. Preferred stock issued by

BMW AG was divided into 52,196,162 shares with a

par-value of one euro, unchanged from the previous

year. Unlike the common stock, no voting rights are

attached to the preferred stock. All of the company’s

stock is issued to bearer. Preferred stock bears an

advance profit (additional dividend) of euro 0.02 per

share. 689,375 of the shares of preferred stock are

only entitled to receive dividends with effect from

the beginning of the financial year 2007.

During the financial year 2006, BMW Group

acquired 689,375 treasury shares of preferred stock

at an average price of euro 37.52 per share; these

shares were issued to employees at a reduced price

of euro 27.84 per share in conjunction with an em-

ployee share scheme. As a result of the repurchase

of shares of preferred stock and their

subsequent

issue, the preferred stock portion of share capital

re-

mained unchanged at euro 52 million.

At the Annual General Meeting of BMW AG

on

12 May 2005, the shareholders authorised the

Board of Management to acquire treasury shares

via the stock exchange, up to a maximum of 10% of

the share capital in place at the date of the resolution

and to withdraw these shares from circulation without

any further resolution by the Annual General Meeting.

The authorisation for the buy-back was valid until

11 November 2006.

In conjunction with this authorisation, the Board

of Management of BMW AG resolved on 20 Sep-

tember 2005 to put a programme in place to buy

back shares via the stock exchange. Under this

pro-

gramme, 3% of BMW AG’s common stock was

acquired.

Up to 17 February 2006, a total of 20,232,722

treasury shares of common stock were bought back

via the stock exchange at an average price per share

of euro 37.47 and a total acquisition cost of euro

758 million. These shares were withdrawn from cir-

culation in accordance with the resolution taken by

the Board of Management on 21 February 2006.

Equity was reduced by the buy-back amount.

Transaction costs amounted to euro 0.776 mil-

lion (net of income tax effect) and were recognised

directly in equity.

At the Annual General Meeting on 16 May 2006,

the shareholders authorised the Board of Manage-

ment to acquire treasury shares via the stock ex-

change, up to a maximum of 10% of the share capital

in place at the date of the resolution and to withdraw

these shares from circulationwithout anyfurther reso-

lution by the Annual General Meeting. At

the same

time, the authorisation from 12 May 2005 to acquire

treasury shares was rescinded. The authorisation

from 16 May 2006 is valid until15 November

2007.

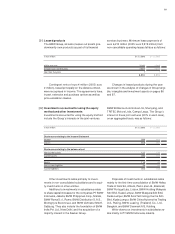

Capital reserves

The capital reserves comprise additional paid in

capital on the issue of shares. The balance reported

decreased by euro 60 million to euro 1,911 million

as a result of the withdrawal of treasury shares from

circulation.

Revenue reserves

Revenue reserves comprise the post-acquisition

and non-distributed earnings of consolidated group

companies. In addition, revenue reserves include

both positive and negative goodwill arising on the

consolidation of group companies prior to 31Decem-

ber

1994.

Revenue reserves stood at euro18,121 million at

31 December 2006, 10.8% higher than one year

earlier. They were increased in 2006 by the amount

of the net profit attributable to shareholders of

BMW

AG amounting to euro 2,868 million and were

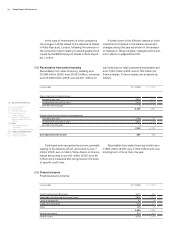

Cash and cash equivalents

Cash and cash equivalents of euro 1,336 million

(2005: euro 1,621 million) comprise cash on hand

and at bank, all with a maturity of under three

months.

[28]

[29]

[30]