BMW 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58 Group Management Report

10 Group Management Report

10 A Review of the Financial Year

12

General EconomicEnvironment

15 Review of operations

38 BMW Stock and Bonds

41 Disclosures pursuant to §289 (4)

and §315 (4) HGB

43 Financial Analysis

43 – Internal Management System

44 – Earnings performance

46 – Financial position

48 – Net assets position

50 – Subsequent events report

50 – Value added statement

53 – Key performance figures

54 – Comments on BMW AG

58 Risk Management

62 Outlook

Risk management in the BMW Group

As a globally operating enterprise, the BMW Group

is confronted with numerous risks. At the same

time, opportunities can arise from changing circum-

stances, which the BMW Group endeavours to an-

ticipate and exploit to improve its competitive position.

Business risks are only consciously entered into

when it is considered that the value of the business

can be increased and the potential outcome can

be controlled.The Board of Management and Super-

visory

Board are regularly informed about risks

which could have a significant impact on business

development.

In order to identify, evaluate and document the

main risks, the BMW Group uses a comprehensive

risk management system which involves the following

processes:

– Business decisions are reached after in-depth

project analyses, including detailed information

concerning potential risks and opportunities, have

been taken into consideration. In addition, as part

of the long-term planning strategy and short-

term forecasting procedures, the risks and oppor-

tunities attached to specific business activities

are evaluated and used as the basis for setting

targets and implementing appropriate risk-miti-

gation measures.

– The Group reporting system keeps all decision-

makers fully informed and up-to-date about per-

formance against targets and highlights changes

affecting the market and competitors. By

con-

tinuous monitoring of critical success factors,

variances are identified at an early stage, thus

allowing appropriate counter-measures to be im-

plemented.

– Overall risk management is supervised by the

corporate controlling department and is reviewed

for its appropriateness and effectiveness by exter-

nal auditors and by the Group’s internal audit de-

partment.Throughout the BMW Group, a network

of risk managers is in place, regularly carrying

out risk reviews to identify and analyse significant

risks. The results of the reviews are summarised

in a separate risk report which is then presented

to the Board of Management.

– By regularly sharing experiences with other com-

panies, the BMW Group ensures that innovative

ideas and approaches flow into the risk

manage-

ment system and that operational riskmanagement

is subjected to continual improvement.

At present, no risks have been identified which could

threaten the existence of the Group or which could

have a materially adverse impact on the net assets,

financial position or results of operations of the Group.

However, risks can never be entirely ruled out.

In the course of its business activities, the BMW

Group is exposed to various types of risk:

Risks relating to the general economic

environment

– As a result of its global activities, the BMW Group

is affected by global economic factors such as

changes in currency parities and changes on the

financial markets. The US dollar is particularly

important for the development of group revenues

and earnings and represents the main single

source of risk within the BMW Group’s foreign

currency portfolio. Exchange rate fluctuations of

the British pound and the Japanese yen in relation

to the euro can also have a material impact on

earnings. Based on group forecasts, these three

currencies account for some 80% of the foreign

currency exposure of the BMW Group.

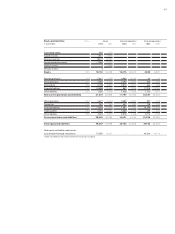

The BMW Group manages currency risks at both

a strategic and an operating level.

From a strategic point of view, i.e. in the medium

and long-term, the BMW Group endeavours to

manage foreign exchange risks by “natural hedg-

ing”, in other words by increasing the volume of

purchases denominated in foreign currency or

increasing the volume of local production. Cur-

rency risks are hedged in the short and medium

term on the financial markets. Hedging transac-

tions are entered into only with financial partners

of first-class credit standing. The nature and

scope of such measures are set out in guidelines

applicable throughout the BMW Group. A cash-

flow-at-risk model and scenario analyses are

used to measure exchange rate risks. These in-

struments are also used as part of the process of

currency management for the purpose of taking

business decisions.

– Changes in the international commodity markets

also have an impact on the business development

of the BMW Group. In order to safeguard the

sup-

ply of production materials and to minimise the

cost risk, the commodity markets relevant for the

BMW Group are closely monitored.The market price

trend of precious metals such as platinum, palla-

dium

and rhodium, for which appropriate hedging

Risk Management