BMW 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

the expectation that a greater volume of tax losses

will be utilisable, especially in the United Kingdom.

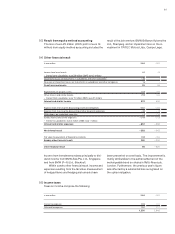

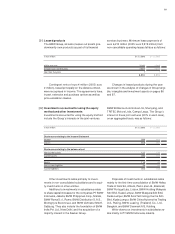

Tax losses available for carryforward, which for the

most part can be carried forward without restriction,

totalled euro 1.7 billion at the year-end (31.12.2005:

euro 2.1 billion). A valuation allowance of euro 65 mil-

lion (2005: euro 188 million) was recognised in

2006 on deferred tax assets relating to tax losses.

Deferred tax assets of euro 463 million (31.12.2005:

euro 453 million) relating to capital losses in the

United Kingdom of euro 1.5 billion (unchanged) were

written down in full since these losses can only be

offset

against capital gains, but not against operating

profits.

The increase of deferred tax assets relating

to liabilities was due primarily to the higher level of

other liabilities and the related increase in temporary

differences.

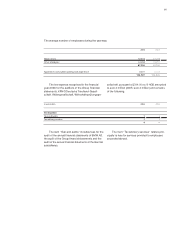

Deferred taxes recognised directly in equity

amounted to euro 512 million (31.12.2005: euro 727

million), whereby the decrease was mainly due to

actuarial gains and losses arising in conjunction with

pension obligations. The level of actuarial gains and

losses in 2006 was affected in particular by the in-

crease in the discount factors applied.

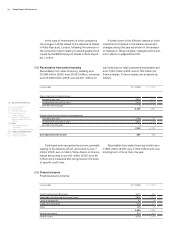

Deferred taxes are not recognised on retained

profits of euro 13,866 million (31.12.2005: euro

12,413 million) of foreign subsidiaries, as it is intended

to invest these profits to maintain and expand the

business volume of the relevant companies.

A computation was not made of the potential impact

of income taxes on the grounds of disproportionate

expense.

The tax returns of the BMW Group entities are

checked regularly by German and foreign tax author-

ities. Taking account of a variety of factors – including

existing interpretations, commentaries and legal de-

cisions relating to the various tax jurisdictions and

the BMW Group’s past experience – adequate provi-

sion has, as far as identifiable, been made for poten-

tial future tax obligations.

The actual tax expense for the financial year 2006

of euro 1,250 million (2005: euro 1,048 million) is

euro 354 million (2005: euro 231 million) lower than

the expected tax expense of euro 1,604 million (2005:

euro 1,279 million) which would theoretically arise

if the tax rate of 38.9% (unchanged), applicable for

German companies, was applied across the Group.

The difference between the expected and actual

tax

expense is attributable to the following:

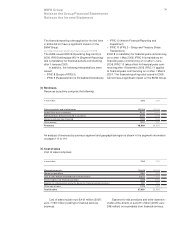

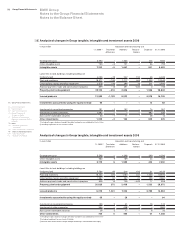

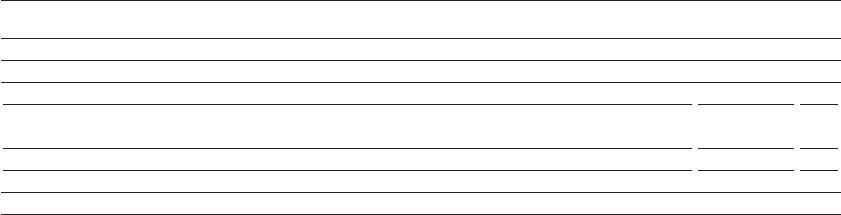

in euro million 2006 2005

Expected tax expense 1,604 1,279

Variances due to different tax rates –213 –123

Tax reductions (–)/tax increases (+) as a result of non-taxable income and

non-deductible expenses –68 158

Tax expense (+)/benefits (–) for prior periods –94 –232

Other variances 21 –34

Actual tax expense 1,250 1,048

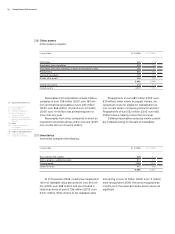

The slightly lower effective tax rate is partially

due to lower nominal tax rates in a number of coun-

tries. The tax-exempt gain on the partial settlement

of the exchangeable bond on shares in Rolls-Royce

plc, London, also had an impact. Furthermore, legis-

lation relating to the taxation of retained earnings in

Germany has changed as a result of §37 (5) of the

German Corporation Tax Act (new version). For this

reason, the present value of the tax reimbursements

arising under the new rules was recognised as an

asset for the first time in 2006.