BMW 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54 Group Management Report

10 Group Management Report

10 A Review of the Financial Year

12

General EconomicEnvironment

15 Review of operations

38 BMW Stock and Bonds

41 Disclosures pursuant to §289 (4)

and §315 (4) HGB

43 Financial Analysis

43 – Internal Management System

44 – Earnings performance

46 – Financial position

48 – Net assets position

50 – Subsequent events report

50 – Value added statement

53 – Key performance figures

54 – Comments on BMW AG

58 Risk Management

62 Outlook

Comments on the Financial Statements of

BMW AG

Whereas the Group financial statements are drawn

up in accordance with IFRSs issued by the IASB, the

financial statements of BMW AG are drawn up in

accordance with the provisions of the German Com-

mercial Code (HGB). Where it is permitted and con-

sidered sensible, the principles and policies of IFRSs

are also applied in the individual company financial

statements.The pension provision in the individual

company financial statements, for example, is also

determined in accordance with IAS 19 and the full

defined benefit obligation recognised. In numerous

other cases, however, the accounting principles and

policies in the individual company financial state-

ments of BMW AGdiffer from those applied in the

Group financial statements. The main differences

relate to the recognition of intangible assets, depre-

ciation and amortisation methods, the measurement

of inventories and provisions as well as the treat-

ment

of financial assets.

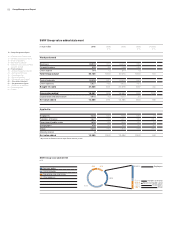

BMW AG develops, manufactures and sells

cars

and motorcycles manufactured by itself and

for-

eign subsidiaries. These vehicles are sold through

the Company’s own branches, independent dealers,

subsidiaries and importers. The number of cars

manufactured at German and foreign plants in 2006

rose by 3.3% to 1,366,838 units. At 31 December

2006, BMW AG had 76,156 employees, 380 fewer

than one year earlier. Wage earners account for

approximately 53 % of the workforce.

In 2006, revenues were 1.5 % higher than in the

previous year. Sales to foreign group sales

compa-

nies accounted for euro 30.8 billion, or approximately

73% of the total revenues of euro 42.4 billion. Cost

of sales remained at approximately the same level as

in 2005, and therefore went up at a slightly slower

rate than revenues. The gross profit, at euro 6.1 bil-

lion, was11.6% higher than in the previous year.

Adverse currency factors relating to the US

dollar and Japanese yen, alongside continued in-

tense

competition on the automobile markets and

increases in raw material prices, all had a negative

impact on BMW AG’s earnings. By contrast, the in-

crease in the interest rate used to measure pension

provisions (from 4.25% to 4.40%) and the dis-

counted tax reimbursement resulting from a change

in German law with regard to the corporation tax

credit, had a positive effect.

In the financial year 2006, capital expenditure on

intangible assets and property, plant and equipment

totalled euro 1,324 million (2005: euro 1,472 million).

This represents a decrease of 10.1% and was mainly

due to completion of structural investment at the

Leipzig plant.Depreciation and amortisation amounted

to euro 1,765 million.

By 17 February 2006, a total of 20,232,722

shares of common stock had been bought back via

the stock exchange at a total acquisition cost of

euro 758 million, and withdrawn from circulation in

accordance with the resolution taken by the Board

of Manangement on 21 February 2006. Of the total

number of shares withdrawn,13,488,480 shares,

with an acquisition cost of euro 506 million, had al-

ready been held by BMW AG at 31 December 2005.

Equity decreased by the amount of the buy-back

value of the shares withdrawn from circulation.The

equity ratio fell from 25.8% to 23.4%. Long-term

external capital (registered profit-sharing certificates,

pension provisions, the liability to the BMW Unter-

stützungsvereins e.V. and liabilities due after one

year) increased marginally (+1.3%) to euro 4.8 billion.

As in previous years, the cash inflow from

BMW AG’s operating activities was used to finance

subsidiaries.