BMW 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

capitalised development costs. The research and

development expenditure ratio for 2006 was 6.5%

(2005: 6.7%).

Depreciation and amortisation of property, plant

and equipment and intangible assets included in cost

of sales, sales and administrative costs and research

and development costs totalled euro 3,272 million

(2005: euro 3,025 million).

The positive net amount from other operating

income and expenses went down by 36.1% com-

pared to the previous year. Other operating income

decreased primarily as a result of lower income from

the reversal of provisions. In the previous year, a

provision relating to the Rover disengagement had

been reversed. Other operating expenses increased

by euro 28 million or 5.7%.

The profit before financial result was up by euro

257million or

6.8% against the previous year, there-

fore reaching a new high level.

The financial result improved by euro 580 million.

This includes the one-off gain of euro 386 million

arising on the partial settlement of the exchangeable

bond on Rolls-Royce plc, London shares.This gain is

reported mostly in “Sundry other financial result” and

the remainder in “Net interest result”. A fair value loss

of euro 14 million was recognised on the remaining

exchangeable bond option obligation relating to the

BMW Group’s investment in Rolls-Royce plc, London,

and is also included in the line item “Sundry other

financial result”. In the previous year, fair value meas-

urement had resulted in a loss of euro 356 million.

Fair value losses on other derivative financial instru-

ments had anegative impact on “Sundry other

finan-

cial result”.The net result from using the equity

method decreased by euro 39 million, primarily as

a result of an impairment loss recognised on TRITEC

Motors Ltda., Campo Largo. The net positive result

from investments was up by euro 4 million. Net

interest expense decreased by euro 41 million.The

net negative amount resulting from unwinding the

discounting on pension obligations and recognising

income for the expected return on pension plan

assets decreased by 6.5% on a year-on-year basis.

In the light of the financial result performance

described above, the group profit before tax im-

proved by 25.5% compared to the previous year.

The pre-tax return on sales was 8.4% (2005: 7.0%).

Excluding the impact of the gain arising on the par-

tial settlement of the exchangeable bond on shares

in Rolls-Royce plc, London, and the fair market loss

arising on the option obligation, the profit before tax

improved by 3.0% to euro 3,752 million.

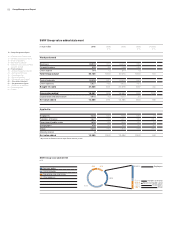

– New car and motorcycles sales volume records

– Group and segment earnings above previous year’s level

– Adverse external factors hold down reported earnings,

qualitative key performance figures nevertheless positive

– Settlement of Rolls-Royce exchangeable bond has one-off

impact on earnings

– Capital expenditure reaches new high level

in euro million 1.1. to 1.1. to

31.12.2006 31.12.2005

Group Income Statement

Revenues 48,999 46,656

Cost of sales –37,660 –35,992

Gross profit 11,339 10,664

Sales and administrative costs –4,972 –4,762

Research and development costs –2,544 –2,464

Other operating income and expenses 227 355

Profit before financial result 4,050 3,793

Result from equity accounted investments –25 14

Other financial result 99 –520

Financial result 74 –506

Profit before tax 4,124 3,287

Income taxes –1,250 –1,048

Net profit 2,874 2,239