BMW 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42 Group Management Report

10 Group Management Report

10 A Review of the Financial Year

12

General EconomicEnvironment

15 Review of operations

38 BMW Stock and Bonds

41 Disclosures pursuant to §289 (4)

and §315 (4) HGB

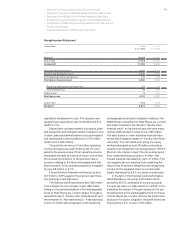

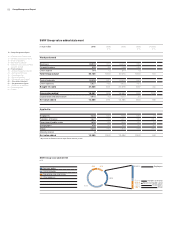

43 Financial Analysis

43 – Internal Management System

44 – Earnings performance

46 – Financial position

48 – Net assets position

50 – Subsequent events report

50 – Value added statement

53 – Key performance figures

54 – Comments on BMW AG

58 Risk Management

62 Outlook

ing the impact of the change of control on the co-

operation arrangements are not allayed during the

subsequent discussion process.

– Under the terms of a contractual agreement with

DaimlerChrysler and General Motors, BMW AG

acquires intellectual property rights in conjunc-

tion with a cooperation for the development of a

hybrid propulsion system. The cooperation can

be terminated with immediate effect by either

party if a change of control occurs with respect to

any other contractual party or an affiliate of an-

other contractual party. Examples of a change of

control are the acquisition of beneficial owner-

ship of securities which confer the majority of

voting power or the acquisition of beneficial own-

ership of securities which confer 20 % of the

voting power provided that within18 months a

majority of the shareholder-elected members of

the Supervisory Board are the nominees of the

new beneficial owner as well as certain merger

transactions and the transfer of all or substantially

all of the assets involved in the performance of

the cooperation agreement.

–BMW AG acts as the guarantor for all of the obli-

gations arising from the joint venture agreement

relating to BMW Brilliance Automotive Ltd. in

China. This agreement grants an extraordinary

right of termination to either joint venture partner

in the event that, either directly or indirectly, more

than 25% of the shares of the other party are ac-

quired by a third party or the other party is merged

with another legal entity. The termination of the

joint venture agreement may result in the sale of

the shares to the other joint venture partner or in

the liquidation of the joint venture entity.

– Regarding the trading of derivative financial instru-

ments, framework agreements are in place with

financial institutions and banks (ISDA Master

Agreements), each of which contain extraordinary

rights of termination, which trigger the immediate

settlement of all current transactions, in the event

that the creditworthiness of the respective con-

tractual party is materially weaker following the di-

rect or indirect acquisition of the beneficial owner-

ship of equity securities having the power to elect

a majority of the Supervisory Board of a contrac-

tual party or any other ownership interest enabling

the acquirer to exercise control of a contractual

party or a merger or transfer of assets.

The BMW Group has not concluded any

compen-

sation agreements with members of the Board of

Management or with employees for situations in-

volving a take-over offer.

Supervisory Board is authorised to approve amend-

ments to the Articles of Incorporation which only

affect its wording (Article 14 no.3 of the Articles of

Incorporation). Resolutions are passed at the Annual

General Meeting by simple majority of shares unless

otherwise explicitly required by binding provisions

of law (§20 of the Articles of Incorporation).

There is no authorised or conditional capital at

the reporting date.

In accordance with the resolution passed at the

Annual General Meeting on 16 May 2006, the Board

of Management is authorised, up to 15 November

2007 and subject to the price limits stipulated in the

resolution, to acquire common and/or non-voting

preferred shares via the stock exchange, up to a

maximum of 10% of the share capital in place at the

date of the resolution.

The Board of Management is also authorised,

without any further resolution by the Annual General

Meeting, to withdraw from circulation the treasury

shares (common and/or non-voting preferred

shares) acquired in accordance with the authorisa-

tion described above.

Furthermore, the Board of Management is

authorised to buy back shares and sell bought-back

shares in situations specified in §71 AktG.

The BMW AGis party to the following significant

agreements which contain special provisions for the

event of a change of control or the acquisition of

control which could arise, for example, from a take-

over offer:

– An agreement, concluded with an international

consortium of banks relating to a syndicated credit

line (which was not being utilised at the balance

sheet date), entitles the lending banks to give ex-

traordinary notice to terminate the credit line

(such that all outstanding amounts, including in-

terest, would fall due immediately) if one or more

parties jointly acquire direct or indirect control of

BMW AG. The term “control” is defined as the

acquisition of more than 50% of the share capital

of BMW AG, the right to receive more than 50 %

of the dividend or the right to direct the affairs of

the Company or appoint the majority of members

of the Supervisory Board.

– A cooperation agreement concluded with Peugeot

SA relating to the joint development and produc-

tion of a new family of small (1 to 1.6 litre) petrol-

driven engines entitles each of the cooperation

partners to give extraordinary notification of termi-

nation in the event of a competitor acquiring

control over the other contractual party and if any

concerns of the other contractual party concern-