Anthem Blue Cross 2001 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

AdminaStar Federal, Inc. (“AdminaStar”), a subsidiary of Anthem Insurance, has received several subpoenas from the

OIG and the U.S. Department of Justice, one seeking documents and information concerning its responsibilities as a

Medicare Part B contractor in its Kentucky office, and the others requesting certain financial records and information

of AdminaStar and Anthem Insurance related to the Company’s Medicare fiscal intermediary (Part A) and carrier

(Part B) operations. The Company has made certain disclosures to the government relating to its Medicare Part B

operations in Kentucky. The Company was advised by the government that, in conjunction with its ongoing review of

these matters, the government has also been reviewing separate allegations made by individuals against AdminaStar,

which are included within the same timeframe and involve issues arising from the same nucleus of operative facts as

the government’s ongoing review. The Company is not in a position to predict either the ultimate outcome of these

reviews or the extent of any potential exposure should claims be made against the Company. However, the Company

believes any fines or penalties that may arise from these reviews would not have a material adverse effect on the

consolidated financial condition of the Company.

As a Blue Cross Blue Shield Association licensee, the Company participates in the Federal Employee Program

(“FEP”), a nationwide contract with the Federal Office of Personnel Management to provide coverage to federal

employees and their dependents. On July 11, 2001, the Company received a subpoena from the OIG, Office of

Personnel Management, seeking certain financial documents and information, including information concerning

intercompany transactions, related to operations in Ohio, Indiana and Kentucky under the FEP contract. The

government has advised the Company that, in conjunction with its ongoing review, the government is also reviewing

a separate allegation made by an individual against the Company’s FEP operations, which is included within the

same timeframe and involves issues arising from the same nucleus of operative facts as the government’s ongoing

review. The Company is currently cooperating with the OIG and the U.S. Department of Justice on these matters.

The Company is not in a position to predict either the ultimate outcome of these reviews or the extent of any

potential exposure should claims be made against the Company. There can be no assurance that the ultimate outcome

of these reviews will not have a material adverse effect on the Company’s consolidated results of operations or

financial condition.

Anthem Insurance guaranteed certain financial contingencies of its subsidiary, Anthem Alliance Health Insurance

Company (“Alliance”), under a contract between Alliance and the United States Department of Defense. Under that

contract, Alliance managed and administered the TRICARE Managed Care Support Program for military families

from May 1, 1998 through May 31, 2001. There was no call on the guarantee for the period from May 1, 1998 to

April 30, 1999 (which period is now “closed”), and the Company does not anticipate a call on the guarantee for the

periods beginning May 1, 1999 through May 31, 2001 (which periods remain “open” for possible review by the

Department of Defense).

Vulnerability from Concentrations:

Financial instruments that potentially subject the Company to concentrations of credit risk consist primarily of

investment securities and premiums receivable. All investment securities are managed by professional investment

managers within policies authorized by the board of directors. Such policies limit the amounts that may be invested in

any one issuer and prescribe certain investee company criteria. Concentrations of credit risk with respect to premiums

receivable are limited due to the large number of employer groups that constitute the Company’s customer base in the

geographic regions in which we conduct business. As of December 31, 2001, there were no significant concentrations

of financial instruments in a single investee, industry or geographic location.

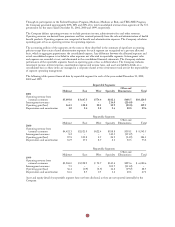

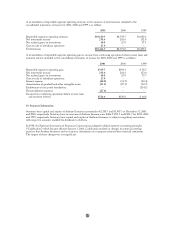

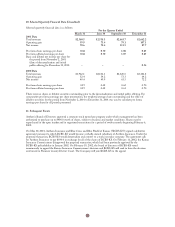

18. Segment Information

The Company’s principal reportable segments are strategic business units primarily delineated by geographic areas

that essentially offer similar insurance products and services. They are managed separately because each geographic

region has unique market, regulatory and healthcare delivery characteristics. The geographic regions are: the Midwest

region, which operates primarily in Indiana, Kentucky and Ohio; the East region, which operates primarily in

Connecticut, New Hampshire and Maine; and the West region, which operates in Colorado and Nevada. BCBS-NH

was added to the East region effective with its October 27, 1999 acquisition, while the West region was established

following the acquisition of BCBS-CO/NV on November 16, 1999. BCBS-ME is included in the East segment since

its acquisition date of June 5, 2000.

In addition to its three principal reportable geographic segments, the Company operates a Specialty segment, which

includes business units providing group life and disability insurance benefits, pharmacy benefit management, dental

and vision administration services and third party occupational health services. Various ancillary business units

(reported with the Other segment) consist primarily of AdminaStar Federal which administers Medicare programs in

Indiana, Illinois, Kentucky and Ohio and Anthem Alliance, which provided health care benefits and administration in

nine states for the Department of Defense’s TRICARE Program for military families. The TRICARE operations

were sold on May 31, 2001. The Other segment also includes intersegment revenue and expense eliminations and

corporate expenses not allocated to reportable segments.