Anthem Blue Cross 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

West

Our West segment is comprised of health benefit and related business for members in Colorado and

Nevada, and it was established following our acquisition of BCBS-CO/NV on November 16, 1999. Results

of this segment have been included in our consolidated results from that date forward. Accordingly, our

1999 results include approximately one and one-half months of activity, while our 2000 results include

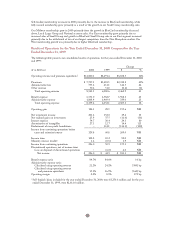

12 months of activity. The following table presents our West segment’s summarized results of operations

for the years ended December 31, 2000 and 1999:

($ in Millions) 2000 1999 % Change

Operating Revenue $ 622.4 $ 72.7 NM0

Operating Gain (Loss) $ 2.5 $ (3.5) NM0

Operating Margin 0.4% (4.8)% 520 bp

Membership (in 000s) 595 486 22%0

Operating results in our West segment improved in 2000, primarily due to reduced administrative expense

as a result of integration savings and cost reduction programs as well as higher membership. These cost

reduction programs included reduced staffing levels and improved productivity in customer service and

claims operations.

Our membership increased 22% due to higher sales and better retention of business, which was the result of

improved customer service and a more comprehensive product portfolio.

Specialty

Our Specialty segment includes our group life and disability, pharmacy benefit management, dental and

vision administration services and third party occupational health services operations. The following table

presents our Specialty segment’s summarized results of operations for the years ended December 31, 2000

and 1999:

($ in Millions) 2000 1999 % Change

Operating Revenue $ 332.3 $ 249.1 33%0

Operating Gain $ 24.9 $ 16.2 54%0

Operating Margin 7.5% 6.5% 100 bp

Operating revenue increased $83.2 million, or 33%, primarily due to an increase in life and disability

premiums resulting from our acquisition of Rocky Mountain Life, or RML, an affiliate of BCBS-CO/NV,

higher life sales in our Midwest region and increased administrative fees due to our acquisitions of

Occupational Healthcare Management Services, Inc., a worker’s compensation third party administration

company, and Health Management Systems, Inc., a dental benefits third party administration company,

both subsidiaries of BCBS-CO/NV. Additionally, other revenue increased primarily from APM. In 2000,

APM began to provide pharmacy benefit management services to both BCBS-NH and Anthem Alliance.

APM’s revenues also increased due to higher mail and retail prescription volumes in line with increased

membership and utilization. Mail service membership increased 26% while retail service membership

increased 80%. Mail service prescription volume increased 15% and retail prescription volume increased 39%.

Operating gain increased $8.7 million, or 54%, while operating margin increased 100 basis points to 7.5%

in 2000, primarily due to improved underwriting results from our life and disability products and from

increased APM volume, following its introduction as the pharmacy benefit manager for recently acquired

membership.

33