Anthem Blue Cross 2001 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

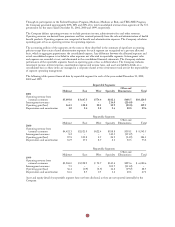

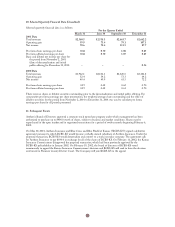

16. Retirement Benefits

Anthem Insurance and its subsidiary, Anthem Health Plans of New Hampshire, Inc. (which acquired the business of

BCBS-NH), sponsor defined benefit pension plans. These plans generally cover all full-time employees who have

completed one year of continuous service and attained the age of twenty-one.

The Company’s plan, which beginning January 1, 2001, includes all affiliates except for Anthem Health Plans of New

Hampshire, Inc., is a cash balance arrangement where participants have an account balance and will earn a pay credit

equal to three to six percent of compensation, depending on years of service. In addition to the pay credit, participant

accounts earn interest at a rate based on the 10-year Treasury notes.

Anthem Health Plans of New Hampshire, Inc. sponsors a plan that is also a cash balance arrangement where

participants have an account balance and will earn a pay credit equal to five percent of compensation. The participant

accounts earn interest at a rate based on the lesser of the 1-year Treasury note or 7%.

Through December 31, 2000, a subsidiary of Rocky Mountain Hospital and Medical Service, Inc. (“RMHMS”)

(formerly known as BCBS-CO/NV) sponsored a pension equity plan where the participants earn retirement credit

percentages based on their age and service when the credit was earned. A lump sum benefit is calculated for each

participant based on this formula. Effective December 31, 2000, the RMHMS plan was frozen and its participants

became participants of the Company’s plan on January 1, 2001. Effective April 30, 2001, the RMHMS plan was

merged into the Company’s plan.

Through December 31, 2000, Anthem Health Plans of Maine, Inc. (which acquired the business of BCBS-ME)

sponsored a final average pay defined benefit plan with contributions made at a rate intended to fund the cost of

benefits earned. The plan’s benefits are based on years of service and the participant’s highest five year average

compensation during the last ten years of employment. Effective December 31, 2000, the Anthem Health Plans of

Maine, Inc. plan was merged into the Company’s plan and its participants became participants of the Company’s

plan on January 1, 2001.

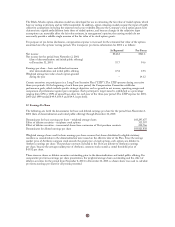

All of the plans’ assets consist primarily of common and preferred stocks, bonds, notes, government securities,

investment funds and short-term investments. The funding policies for all plans are to contribute amounts at least

sufficient to meet the minimum funding requirements set forth in the Employee Retirement Income Security Act plus

such additional amounts as are necessary to provide assets sufficient to meet the benefits to be paid to plan members.

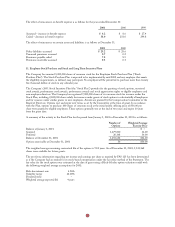

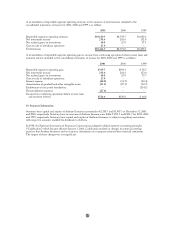

The effect of acquisitions on the consolidated benefit obligation and plan assets is reflected through the business

combination lines of the tables below.

In addition to the Company’s defined benefit and defined contribution plans, the Company offers most employees

certain life, health, vision and dental benefits upon retirement. There are several plans, which differ in amounts of

coverage, deductibles, retiree contributions, years of service and retirement age. The Company funds certain benefit

costs through contributions to a Voluntary Employees’ Beneficiary Association (“VEBA”) trust and others are accrued,

with the retiree paying a portion of the costs. Postretirement plan assets held in the VEBA trust consist primarily of

bonds and equity securities.