Anthem Blue Cross 2001 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

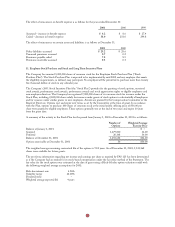

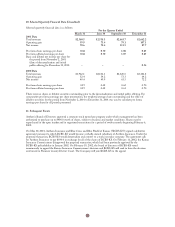

The reconciliations of the benefit obligation based on a measurement date of September 30 are as follows:

Pension Benefits Other Benefits

2001 2000 2001 2000

Benefit obligation at beginning of year $567.6 $471.8 $111.6 $117.1

Service cost 29.3 27.3 1.5 1.3

Interest cost 40.9 36.6 8.7 8.4

Plan amendments (6.8) (1.2) 1.5 (5.2)

Actuarial (gain) loss (5.5) 35.4 31.7 (11.0)

Benefits paid (42.6) (53.1) (10.7) (8.0)

Business combinations –50.8 –9.0

Benefit obligation at end of year $582.9 $567.6 $144.3 $111.6

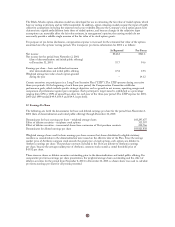

The changes in plan assets were as follows:

Pension Benefits Other Benefits

2001 2000 2001 2000

Fair value of plan assets at

beginning of year $650.6 $557.5 $ 28.4 $ 23.2

Actual return on plan assets (115.7) 75.3 (3.6) 3.1

Employer contributions 3.0 30.0 2.0 1.2

Benefits paid (42.6) (53.1) (3.1) (3.7)

Business combinations –40.9 –4.6

Fair value of plan assets at end of year $495.3 $650.6 $ 23.7 $ 28.4

The reconciliations of the funded status to the net benefit cost accrued are as follows:

Pension Benefits Other Benefits

2001 2000 2001 2000

Funded status $ (87.6) $ 83.0 $(120.6) $ (83.2)

Unrecognized net loss (gain) 103.2 (61.5) (5.1) (44.1)

Unrecognized prior service cost (25.3) (22.8) (33.6) (41.9)

Unrecognized transition asset –(1.0) ––

Additional minimum liability (6.5) (7.2) ––

Accrued benefit cost at September 30 (16.2) (9.5) (159.3) (169.2)

Payments made after the measurement date 76.7 1.0 2.7 2.6

Prepaid (accrued) benefit cost at December 31 $ 60.5 $ (8.5) $(156.6) $(166.6)

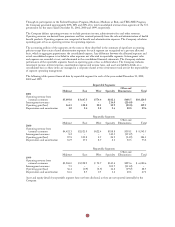

The weighted average assumptions used in calculating the accrued liabilities for all plans are as follows:

Pension Benefits Other Benefits

2001 2000 1999 2001 2000 1999

Discount rate 7.25% 7.50% 7.50% 7.25% 7.50% 7.50%

Rate of compensation increase 4.50% 4.50% 4.50% 4.50% 4.50% 4.50%

Expected rate of return on plan assets 9.00% 9.00% 9.00% 6.50% 6.27% 6.50%

The assumed health care cost trend rate used in measuring the other benefit obligations is generally 6% in 2000 and

7% in 1999, and is assumed to decrease 1% per year to 5% through September 30, 2001. Beginning October 1, 2001,

the assumed health care trend rate is 10% decreasing 1% per year to 5% in 2007.