Anthem Blue Cross 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

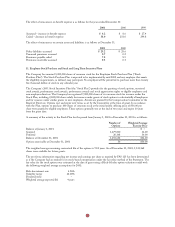

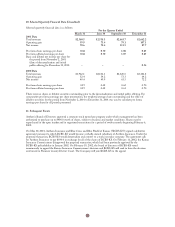

A reconciliation between actual income tax expense and the amount computed at the statutory rate is as follows:

2001 2000 1999

Amount % Amount % Amount %

Amount at statutory rate $183.6 35.0 $115.4 35.0 $ 21.3 35.0

State and local income taxes (benefit)

net of federal tax benefit 3.5 0.7 2.6 0.8 (4.8) (7.9)

Amortization of goodwill 5.9 1.1 5.6 1.7 3.1 5.1

Dividends received deduction (1.4) (0.2) (1.2) (0.4) (1.3) (2.1)

Deferred tax valuation allowance change,

net of net operating loss carryforwards

and other tax credits (20.3) (3.9) (20.0) (6.0) (14.4) (23.7)

Other, net 12.1 2.3 (0.2) (0.1) 6.3 10.4

$183.4 35.0 $102.2 31.0 $ 10.2 16.8

At December 31, 2001, the Company had unused federal tax net operating loss carryforwards of approximately

$189.1 to offset future taxable income. The loss carryforwards expire in the years 2002 through 2019.

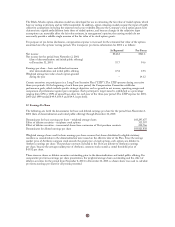

14. Accumulated Other Comprehensive Income

The following is a reconciliation of the components of accumulated other comprehensive income at

December 31:

2001 2000

Gross unrealized gains on investments $ 90.4 $199.1

Gross unrealized losses on investments (18.4) (81.8)

Total pretax net unrealized gains on investments 72.0 117.3

Deferred tax liability (25.4) (41.4)

Net unrealized gains on investments 46.6 75.9

Additional minimum pension liability (6.5) (7.2)

Deferred tax asset 2.3 2.5

Net additional minimum pension liability (4.2) (4.7)

Accumulated other comprehensive income $ 42.4 $ 71.2

A reconciliation of the change in unrealized and realized gains (losses) on investments included in accumulated other

comprehensive income follows:

2001 2000 1999

Change in pretax net unrealized gains on investments $ 15.5 $ 83.1 $(99.2)

Less change in deferred taxes (5.3) (28.4) 36.9

Less net realized gains on investments, net of income

taxes (2001, $21.3; 2000, $8.0; 1999, $11.3),

included in net income (39.5) (17.9) (26.2)

Change in net unrealized gains (losses) on investments $ (29.3) $ 36.8 $(88.5)

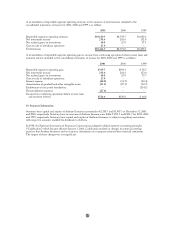

15. Leases

The Company leases office space and certain computer equipment using noncancelable operating leases. Related lease

expense for 2001, 2000 and 1999 was $45.2, $64.0, and $60.9, respectively.

At December 31, 2001, future lease payments for operating leases with initial or remaining noncancelable terms of

one year or more consisted of the following: 2002, $35.7; 2003, $32.0; 2004, $27.0; 2005, $24.4; 2006, $21.9; and

thereafter $145.8.