Anthem Blue Cross 2001 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

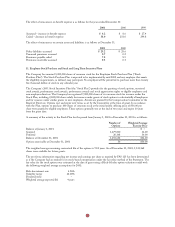

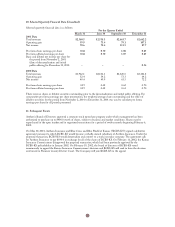

The health care cost trend rate assumption can have a significant effect on the amounts reported. A one-percentage-

point change in assumed health care cost trend rates would have the following effects:

1-Percentage 1-Percentage

Point Increase Point Decrease

Effect on total of service and interest cost components $0.4 $(0.4)

Effect on the accumulated postretirement benefit obligation 7.9 (6.5)

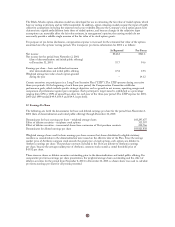

Below are the components of net periodic benefit cost:

Pension Benefits Other Benefits

2001 2000 1999 2001 2000 1999

Service cost $29.3 $27.3 $26.6 $ 1.5 $1.3 $ 2.1

Interest cost 40.9 36.6 31.4 8.7 8.4 6.2

Expected return on assets (55.1) (49.9) (39.6) (1.8) (1.4) (1.2)

Recognized actuarial (gain) loss 0.3 2.8 1.2 (1.7) (1.7) (2.4)

Amortization of prior service cost (3.9) (3.3) (3.3) (6.8) (6.5) (5.4)

Amortization of transition asset (1.0) (1.7) (2.0) –––

Net periodic benefit cost (credit)

before curtailments 10.5 11.8 14.3 (0.1) 0.1 (0.7)

Net settlement/curtailment credit –– (7.9) –––

Net periodic benefit cost (credit) $10.5 $11.8 $ 6.4 $(0.1) $0.1 $(0.7)

The net settlement/curtailment credit in 1999 result from the divestitures of several non-core businesses as previously

discussed in Note 3.

The Company has several qualified defined contribution plans covering substantially all employees. Eligible employees

may only participate in one plan. Voluntary employee contributions are matched at the rate of 50%, up to a maximum

depending upon the plan, subject to certain limitations. Contributions made by the Company totaled $11.2, $10.3

and $8.7 during 2001, 2000 and 1999, respectively.

17. Contingencies

Litigation:

A number of managed care organizations have been sued in class action lawsuits asserting various causes of action

under federal and state law. These lawsuits typically allege that the defendant managed care organizations employ

policies and procedures for providing health care benefits that are inconsistent with the terms of the coverage

documents and other information provided to their members, and because of these misrepresentations and practices, a

class of members has been injured in that they received benefits of lesser value than the benefits represented to and

paid for by such members. Two such proceedings which allege various violations of the Employee Retirement Income

Security Act of 1974 (“ERISA”) have been filed in Connecticut against the Company or its Connecticut subsidiary.

One proceeding was brought by the Connecticut Attorney General on behalf of a purported class of HMO and Point

of Service members in Connecticut. No monetary damages are sought, although the suit does seek injunctive relief

from the court to preclude the Company from allegedly utilizing arbitrary coverage guidelines, making late payments

to providers or members, denying coverage for medically necessary prescription drugs and misrepresenting or failing

to disclose essential information to enrollees. The complaint contends that these alleged policies and practices are a

violation of ERISA. A second proceeding, brought on behalf of a purported class of HMO and Point of Service

members in Connecticut and elsewhere, seeks injunctive relief to preclude the Company from allegedly making

coverage decisions relating to medical necessity without complying with the express terms of the policy documents,

and unspecified monetary damages (both compensatory and punitive).

In addition, the Company’s Connecticut subsidiary is a defendant in three class action lawsuits brought on behalf of

professional providers in Connecticut. The suits allege that the Connecticut subsidiary has breached its contracts by,

among other things, failing to pay for services in accordance with the terms of the contracts. The suits also allege

violations of the Connecticut Unfair Trade Practices Act, breach of the implied duty of good faith and fair dealing,

negligent misrepresentation and unjust enrichment. Two of the suits seek injunctive relief and monetary damages

(both compensatory and punitive). The third suit, brought by the Connecticut State Medical Society, seeks

injunctive relief only.