Anthem Blue Cross 2001 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

13. Income Taxes

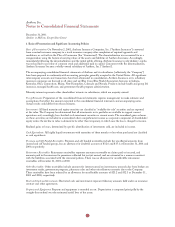

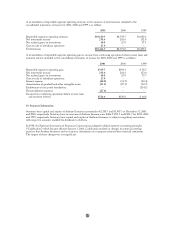

The components of deferred income taxes at December 31 are as follows:

2001 2000

Deferred tax assets:

Pension and postretirement benefits $ 60.5 $ 84.7

Accrued expenses 98.3 85.2

Alternative minimum tax and other credits 133.5 83.7

Insurance reserves 47.8 33.0

Net operating loss carryforwards 66.2 174.5

Bad debt reserves 19.8 35.1

Other 41.0 31.5

Total deferred tax assets 467.1 527.7

Valuation allowance (250.4) (338.7)

Total deferred tax assets, net of valuation allowance 216.7 189.0

Deferred tax liabilities:

Unrealized gains on securities 25.4 41.4

Goodwill and other intangible assets 70.0 55.1

Other 184.9 72.4

Total deferred tax liabilities 280.3 168.9

Net deferred tax asset (liability) $ (63.6) $ 20.1

The resolution of an Internal Revenue Service examination during 2000 resulted in certain subsidiaries having an

increase in alternative minimum tax credits and net operating loss carryforwards. Due to the uncertainty of the

realization of these deferred tax assets, the Company increased its valuation allowance accordingly. During 2001,

portions of these net operating loss carryforwards were utilized and the valuation allowance was reduced accordingly.

The net change in the valuation allowance for 2001, 2000 and 1999 totaled $(88.3), $190.5 and $(14.4), respectively.

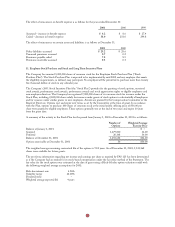

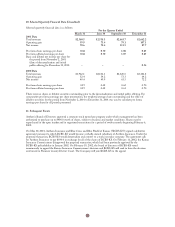

Deferred tax assets and liabilities reported with other current assets or liabilities and other noncurrent assets or

liabilities on the accompanying consolidated balance sheets at December 31 are as follows:

2001 2000

Deferred tax asset (liability) – current $ (8.3) $ 10.5

Deferred tax asset (liability) – noncurrent (55.3) 9.6

Net deferred tax asset (liability) $(63.6) $ 20.1

Significant components of the provision for income taxes consist of the following:

2001 2000 1999

Current tax expense (benefit):

Federal $101.1 $ 53.9 $ (2.6)

State and local 7.7 3.9 (7.0)

Total current tax expense (benefit) 108.8 57.8 (9.6)

Deferred tax expense 74.6 44.4 19.8

Total income tax expense $183.4 $102.2 $ 10.2

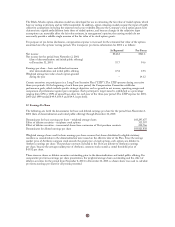

Current federal income taxes consisted of amounts due for alternative minimum tax and tax obligations of subsidiaries

not included in the consolidated return of Anthem. During 2001, 2000 and 1999 federal income taxes paid totaled

$74.1, $26.3 and $0.0, respectively.