Anthem Blue Cross 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

Introduction

We are one of the nation’s largest health benefits companies and an independent licensee of the Blue Cross

Blue Shield Association, or BCBSA. We offer Blue Cross Blue Shield branded products to nearly eight

million members throughout Indiana, Kentucky, Ohio, Connecticut, New Hampshire, Maine, Colorado

and Nevada.

Our reportable segments are strategic business units delineated by geographic areas within which we offer

similar products and services. We manage our business units with a local focus to address each geographic

region’s unique market, regulatory and healthcare delivery characteristics. Our segments are: Midwest, which

includes Indiana, Kentucky and Ohio; East, which includes Connecticut, New Hampshire and Maine; and

West, which includes Colorado and Nevada.

In addition to our three geographic segments, we operate a Specialty segment that includes business units

providing group life and disability insurance benefits, pharmacy benefit management, dental and vision

administration services and third party occupational health services. Our Other segment is comprised of

AdminaStar Federal, Anthem Alliance Health Insurance Company, or Anthem Alliance, intersegment

revenue and expense eliminations and corporate expenses not allocated to reportable segments. AdminaStar

Federal is a subsidiary that administers Medicare programs in Indiana, Illinois, Kentucky and Ohio.

Anthem Alliance is a subsidiary that primarily provided health care benefits and administration in nine

states for the Department of Defense’s TRICARE Program for military families until we sold our

TRICARE operations on May 31, 2001.

We offer traditional indemnity products and a diversified mix of managed care products, including health

maintenance organizations or HMOs, preferred provider organizations or PPOs, and point of service or

POS plans. We also provide a broad array of managed care services and partially insured products to self-

funded employers, including underwriting, stop loss insurance, actuarial services, provider network access,

medical cost management, claims processing and other administrative services. Our operating revenue

consists of premiums, benefit plan administrative fees and other revenue. The premiums come from fully

insured contracts where we indemnify our policyholders against loss. The administrative fees come from

self-funded contracts where our contract holders are wholly or partially self-insured and from the

administration of Medicare programs. Other revenue is principally generated by our pharmacy benefit

management company in the form of co-pays and deductibles associated with the sale of mail order drugs.

Our benefit expense consists mostly of four cost of care components: outpatient and inpatient care costs,

physician costs and pharmacy benefit costs. All four components are affected both by unit costs and

utilization rates. Unit costs, for example, are the cost of outpatient medical procedures, inpatient hospital

stays, physician fees for office visits and prescription drug prices. Utilization rates represent the volume of

consumption of health services and vary with the age and health of our members and broader social and

lifestyle factors in the population as a whole.

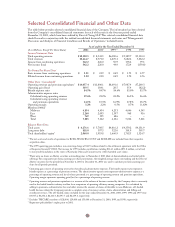

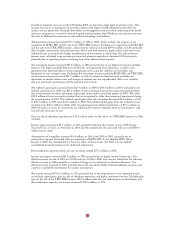

Our results in 1999, 2000 and 2001 were significantly impacted by the acquisitions of Blue Cross and Blue

Shield of New Hampshire, or BCBS-NH, which we completed on October 27, 1999, Blue Cross and Blue

Shield of Colorado and Nevada, or BCBS-CO/NV, which we completed on November 16, 1999, and Blue

Cross and Blue Shield of Maine, or BCBS-ME, which we completed on June 5, 2000. We accounted for

these acquisitions as purchases and we included the net assets and results of operations in our consolidated

financial statements from the respective dates of purchase. The following represents the contribution to our

total revenues, operating gain, assets and membership in the year of and subsequent to each acquisition for

the years ended December 31, 2001, 2000 and 1999.

18