Anthem Blue Cross 2001 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

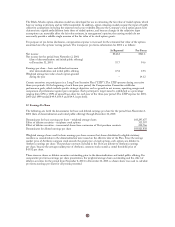

Goodwill and Other Intangible Assets: Goodwill represents the excess of cost of acquisition over the fair value of net

assets acquired. Other intangible assets represent the values assigned to licenses, non-compete and other agreements.

Goodwill and other intangible assets are amortized using the straight-line method over periods ranging from two to

20 years. Accumulated amortization of goodwill and other intangible assets at December 31, 2001 and 2000 was

$90.8 and $58.4, respectively. The carrying value of goodwill and other intangible assets is reviewed annually to

determine if the facts and circumstances indicate that they may be impaired. The carrying value of these assets is

reduced to its fair value if this review, which includes comparison of asset carrying amounts to expected cash flows,

indicates that such amounts will not be recoverable.

In July 2001, the Financial Accounting Standards Board issued FAS 141, Business Combinations, and FAS 142,

Goodwill and Other Intangible Assets. FAS 141 requires business combinations completed after June 30, 2001 to be

accounted for using the purchase method of accounting. It also specifies the types of acquired intangible assets that

are required to be recognized and reported separately from goodwill. Under FAS 142, goodwill and certain other

intangible assets (with indefinite lives) will not be amortized but will be tested for impairment at least annually. The

Company plans to adopt FAS 142 on January 1, 2002 and does not expect any impairment of goodwill upon

adoption. If the Company had adopted FAS 142 on January 1, 2001, income before income taxes and minority

interest and net income for the year ended December 31, 2001, would have increased by $17.5 and $15.2, respectively.

Policy Liabilities: Liabilities for unpaid claims include estimated provisions for both reported and unreported claims

incurred on an undiscounted basis. The liabilities are adjusted regularly based on historical experience and include

estimates of trends in claim severity and frequency and other factors, which could vary as the claims are ultimately

settled. Although it is not possible to measure the degree of variability inherent in such estimates, management

believes these liabilities are adequate.

The life future policy benefit liabilities represent primarily group term benefits determined using standard industry

mortality tables with interest rates ranging from 3.0% to 5.5%.

Premium deficiency losses are recognized when it is probable that expected claims and loss adjustment expenses will

exceed future premiums on existing health and other insurance contracts without consideration of investment income.

For purposes of premium deficiency losses, contracts are deemed to be either short or long duration and are grouped

in a manner consistent with the Company’s method of acquiring, servicing and measuring the profitability of such

contracts.

Retirement Benefits: Retirement benefits represent outstanding obligations for retiree health, life and dental benefits

and any unfunded liability related to defined benefit pension plans.

Comprehensive Income: Comprehensive income includes net income, the change in unrealized gains (losses) on

investments and the change in the additional minimum pension liability.

Revenue Recognition: Gross premiums for fully insured contracts are prorated over the term of the contracts, with the

unearned premium representing the unexpired term of policies. For insurance contracts with retrospective rated

premiums, the estimated ultimate premium is recognized as revenue over the period of the contract. Actual experience

is reviewed once the policy period is completed and adjustments are recorded when determined. Premium rates for

certain lines of business are subject to approval by the Department of Insurance of each respective state.

Administrative fees include revenue from certain group contracts that provide for the group to be at risk for all, or

with supplemental insurance arrangements, a portion of their claims experience. The Company charges self-funded

groups an administrative fee which is based on the number of members in a group or the group’s claim experience.

Under the Company’s self-funded arrangements, amounts due are recognized based on incurred claims paid plus

administrative and other fees. In addition, administrative fees include amounts received for the administration of

Medicare or certain other government programs. Administrative fees are recognized in accordance with the terms of

the contractual relationship between the Company and the customer. Such fees are based on a percentage of the claim

amounts processed or a combination of a fixed fee per claim plus a percentage of the claim amounts processed. All

benefit payments under these programs are excluded from benefit expense.

Other revenue principally includes amounts from the sales of prescription drugs and revenues are recognized as

prescription drug orders are delivered or shipped.

Federal Income Taxes: Anthem files a consolidated return with its subsidiaries that qualify as defined by the Internal

Revenue Code.