Anthem Blue Cross 2001 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

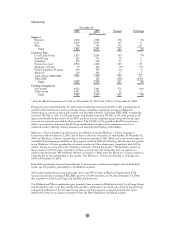

Operating gain increased $25.0 million, or 24%, primarily due to improved underwriting results in Small

Group and Local Large Group businesses, exiting the Medicare + Choice market in Connecticut, and

higher overall membership. Operating margin decreased 10 basis points primarily due to the relatively lower

margins on our Maine business.

Membership increased 167,000, or 8%, primarily in Local Large Group and BlueCard businesses.

On January 17, 2002, a subsidiary of Anthem Insurance, Anthem Health Plans of Maine, Inc., signed a

stock purchase agreement to purchase the remaining 50% ownership interest in Maine Partners Health

Plan, Inc. for an aggregate purchase price of $10.6 million. Subject to the terms and conditions of the

agreement, the transaction is expected to close in the first quarter of 2002.

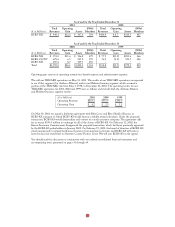

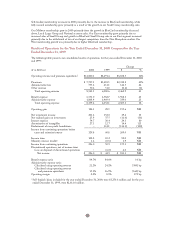

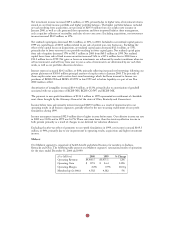

West

Our West segment is comprised of health benefit and related business for members in Colorado and

Nevada. The following table presents our West segment’s summarized results of operations for the years

ended December 31, 2001 and 2000:

($ in Millions) 2001 2000 % Change

Operating Revenue $ 774.4 $ 622.4 24%0

Operating Gain $ 20.1 $ 2.5 704%0

Operating Margin 2.6% 0.4% 220 bp

Membership (in 000s) 769 595 29%0

Operating revenue increased $152.0 million, or 24%, primarily due to higher premium rates designed to

bring our pricing in line with cost of care and higher membership in National and both Local Large Group

and Small Group businesses.

Operating gain increased $17.6 million, to $20.1 million in 2001, primarily due to improved underwriting

performance as a result of premium rate increases exceeding cost of care increases and higher average

membership, particularly in our Local Large Group business. This improvement in our operating gain

resulted in a 220 basis point increase in operating margin to 2.6% in 2001.

Membership increased 174,000, or 29%, to 769,000, due to increased BlueCard activity and higher sales in

Local Large Group and Small Group businesses. We exited the Medicare + Choice market in Colorado

effective January 1, 2002. At December 31, 2001, our Medicare + Choice membership in Colorado was

approximately 6,000. We expect no material effect on operating results from exiting this market.

We entered into an agreement with Sloan’s Lake HMO in Colorado for the conversion of Sloan’s Lake

HMO business effective January 1, 2001. The terms of the agreement include payment to Sloan’s Lake for

each member selecting our product at the group’s renewal date and continuing as our member for a

minimum of nine months. Through December 31, 2001, we added approximately 35,000 members from

Sloan’s Lake.

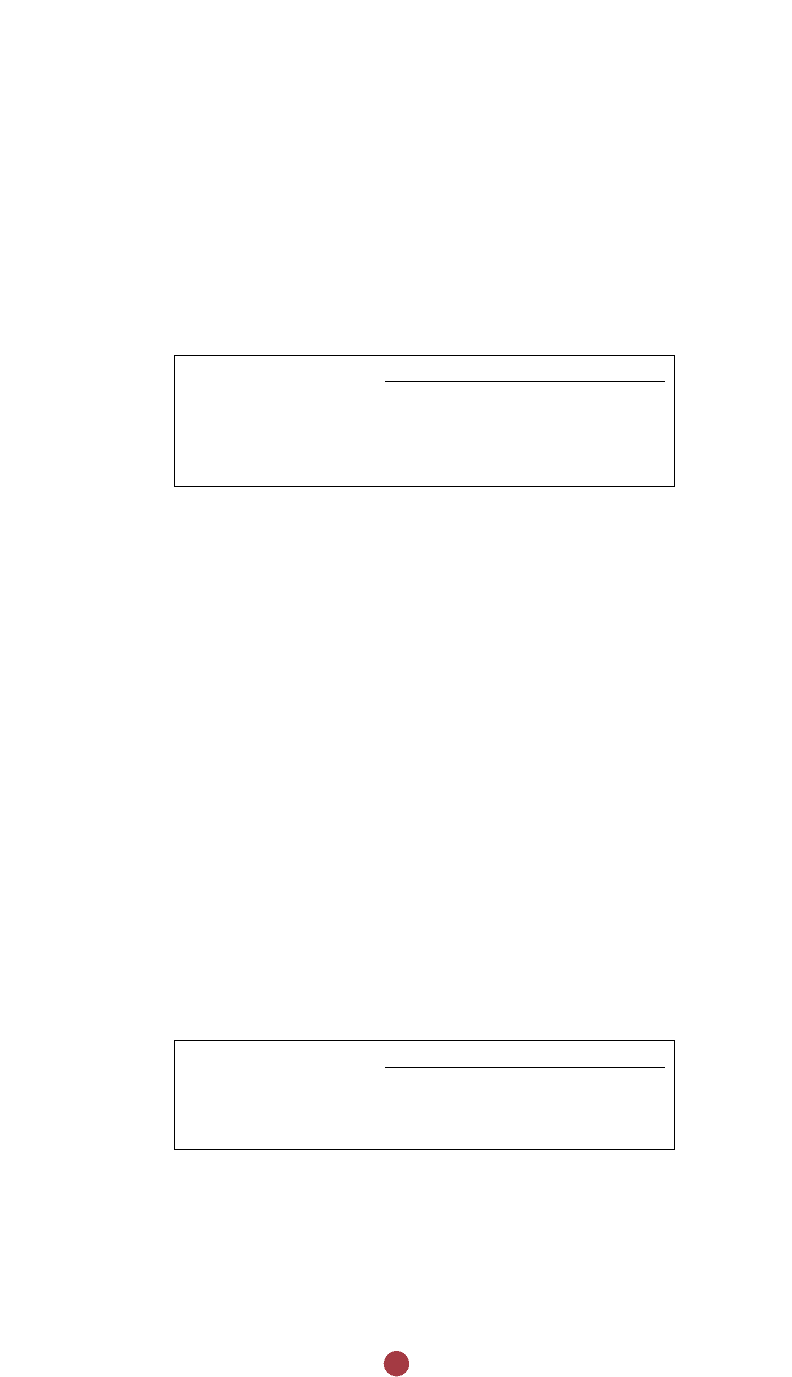

Specialty

Our Specialty segment includes our group life and disability, pharmacy benefit management, dental and

vision administration services, and third party occupational health services. The following table presents our

Specialty segment’s summarized results of operations for the years ended December 31, 2001 and 2000:

($ in Millions) 2001 2000 % Change

Operating Revenue $ 396.1 $ 332.3 19%0

Operating Gain $ 32.9 $ 24.9 32%0

Operating Margin 8.3% 7.5% 80 bp

26