Anthem Blue Cross 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Anthem Blue Cross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Further, because of challenges including industry-wide issues regarding both the timing and the amount of

deductions, we have recorded reserves for probable exposure. To the extent we prevail in matters we have

accrued for or are required to pay more than reserved, our future effective tax rate in any given period could

be materially impacted. In addition, the Internal Revenue Service is currently examining two of our five

open tax years.

Liability for Unpaid Life, Accident and Health Claims

The most significant accounting estimate in our consolidated financial statements is our liability for unpaid

life, accident and health claims. We establish liabilities for pending claims and claims incurred but not

reported. We determine the amount of this liability for each of our business segments by following a

detailed process that entails using both historical claim payment patterns as well as emerging medical cost

trends to project claim liabilities. We also look back to assess how our prior year’s estimates developed and

to the extent appropriate, incorporate those findings in our current year projections. Since the average life of

a claim is just a few months, current medical cost trends and utilization patterns are very important in

establishing this liability.

In addition, the liability for unpaid life, accident and health claims includes reserves for premium deficiency

losses which we recognize when it is probable that expected claims and loss adjustment expenses will exceed

future premiums on existing health and other insurance contracts without consideration of investment

income. For purposes of premium deficiency losses, contracts are deemed to be either short or long duration

and are grouped in a manner consistent with our method of acquiring, servicing and measuring the

profitability of such contracts.

Goodwill and Other Intangible Assets – FAS 141 and FAS 142

Statement of Financial Accounting Standards No. 141, “Business Combinations,” and Statement of

Accounting Standards No. 142, “Goodwill and Other Intangible Assets,” were issued in July 2001. FAS 141

requires business combinations completed after June 30, 2001, to be accounted for using the purchase

method of accounting. It also specifies the types of acquired intangible assets that are required to be

recognized and reported separately from goodwill. Under FAS 142, goodwill and other intangible assets

(with indefinite lives) will not be amortized but will be tested for impairment at least annually. We adopted

FAS 142 on January 1, 2002, and we do not expect to record an impairment charge upon adoption. See

Note 1 to our audited consolidated financial statements for additional information.

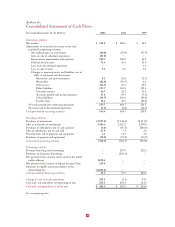

Liquidity and Capital Resources

Our cash receipts consist primarily of premiums and administrative fees, investment income and proceeds

from the sale or maturity of our investment securities. Cash disbursements result mainly from policyholder

benefit payments, administrative expenses and taxes. We also use cash for purchases of investment securities,

capital expenditures and acquisitions. Cash outflows can fluctuate because of uncertainties regarding the

amount and timing of settlement of our liabilities for benefit claims and the timing of payments of

operating expenses. Our investment strategy is to make prudent investments, consistent with insurance

statutes and other regulatory requirements, with the principle of preserving our asset base. Cash inflows

could be adversely impacted by general business conditions including health care costs increasing more than

premium rates, our ability to maintain favorable provider agreements, reduction in enrollment, changes in

federal and state regulation, litigation risks and competition. We believe that cash flow from operations,

together with the investment portfolio, will continue to provide sufficient liquidity to meet general

operations needs, special needs arising from changes in financial position and changes in financial markets.

We also have lines of credit totaling $935.0 million and a $300.0 million commercial paper program to

provide additional liquidity. We have made no borrowings under these facilities. Total borrowings under

these facilities cannot exceed $935.0 million because borrowing under either facility reduces availability

under the other facility.

35